We are Hiring! Click here to see our open positions.

Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

calendar_today May 2, 2023

By Frank A. Burke, CFA, CAIA, Chief Investment Officer

and Anton W. Golding, Associate, Fund Manager Analyst

In the Rearview Mirror

Though it has already been three full years, it will be nearly impossible to ever forget the enormous impacts COVID-19 and the resulting lockdown had on our society. The time was marked by empty streets, offices, schools, and restaurants and contrasted by overcrowded and undersupplied hospitals. While every person and sector was deeply affected by the lockdown, the blow to the hospitality industry was particularly detrimental.

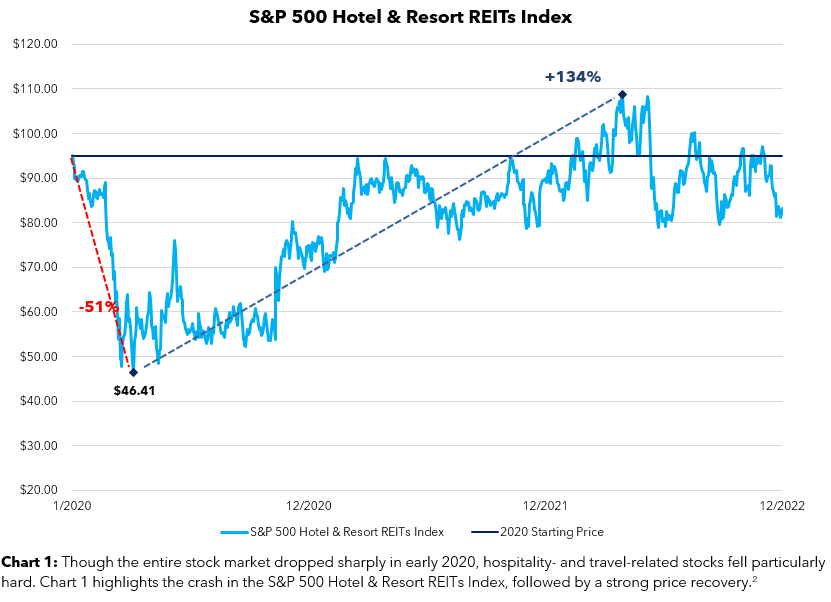

In the first few months of the pandemic in 2020, nearly eight million people in the hospitality industry lost their jobs.1 With businesses relegated to virtual meetings and vacation goers impeded by social distancing, travel for both business and leisure came to a complete stop, as did the once reliable cash flows. During the panic, shares of hotel and resort operators and REITs plummeted as investors lost all confidence in the industry and their ability to predict a recovery. However, like the overall economy, hospitality has bounced back with ferocity, as reflected in fundamentals and prices. Chart 1 is a snapshot of the industry’s fall and recovery.

The Way Back

After the initial market crash and shutdown, much of the economy was able to recover quickly. Consumers, flushed with government checks on top of high levels of saving, spent money on new homes, renovations, clothing, computers, televisions, cars and so on. What was missing, though, were the hundreds or thousands of dollars per person that Americans typically spent each year on vacations and leisure travel. Further, with nearly all meetings being held virtually, business travel—a core piece of hotel revenue and profits—shrank dramatically. Despite all this, headwinds now appear to be changing to tailwinds.

According to Morgan Stanley, corporate travel budgets for 2023 are expected to reach 98% of 2019 levels. Of the group surveyed, 29% plan to increase budgets by more than 10% in 2023, relative to the previous year.3 While video calls may allow for more frequent and convenient long-distance meetings, in-person interactions, from a business and social standpoint, are still highly important and may never be fully replaced.

Outside of business travel, consumers have shifted their attention from purchasing products, as they did in the pandemic, to spending money on experiences. In a way, they’re making up for lost time. At its lowest, international tourist arrivals dipped to 10% of pre-pandemic levels and have recovered to about 73% of previous levels.4 With mounting global demand, hotels have been able to recapture revenue per available room (RevPAR) lost due of the pandemic, with the Americas recovering 105%.5

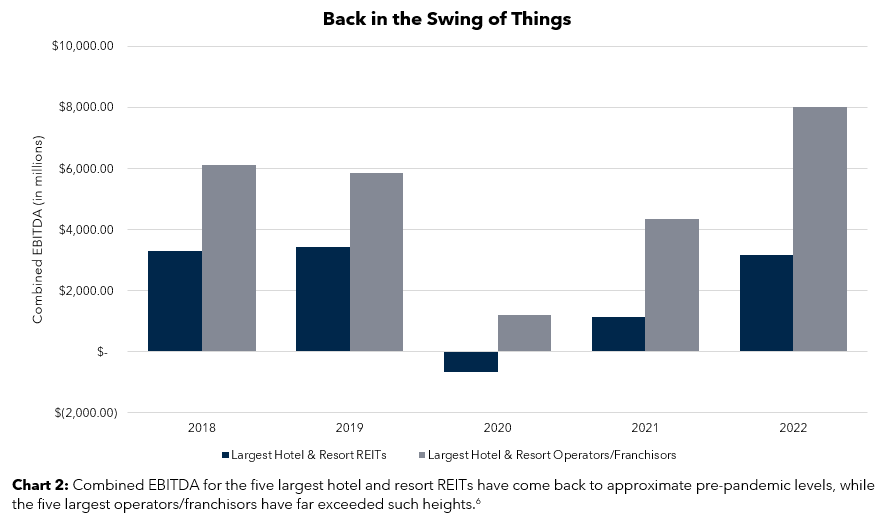

These trends are highlighted in the overall profitability of the largest hospitality REITs and operators/franchisors (Chart 2).

Open Road Ahead

Despite macro headwinds, including inflation and geopolitical tensions in Europe, Asia, and Africa, pent up demand for leisure travel and restored business travel should support continued growth in hospitality fundamentals. Hotels are particularly strong inflation hedges, even when compared to other property types, as they adjust rates daily while office, industrial, and residential properties have long-term leases. In their Global Hotel Investor Sentiment Survey, JLL found that 82% of hotel investors are targeting value-add investments which, combined with the macro themes above, may drive strong total returns.

While investors may gain exposure to the hospitality sector through publicly traded REITs and operators, opportunities in private markets are plenty fruitful. Some exposure can be gained by investing in mega-real estate funds like Blackstone, Brookfield, and Starwood, many of which have been increasing allocations to hospitality. However, fund managers that exclusively invest in single sectors can offer private wealth advisors and their clients with opportunities for thematic and concentrated exposure to a quality business like hotels. Whether they focus on extended stay or luxury resorts, or are developers targeting overlooked markets, these funds can serve as less-correlated components of a real estate sleeve with potential for long-term total returns.

While the pandemic may have caused a once in a lifetime crash in hospitality, it’s important to remember the vast fortunes built by hotels—including those of the Hilton, Pritzker and Marriott families. In the end, hotels are a wonderful and simple business and should be on the radar for allocators looking to diversify and strengthen portfolios.

Important Disclosures

1 U.S. Bureau of Labor Statistics

2 S&P Global

3 Morgan Stanley

4 United Nations World Tourism Organization (UNWTO)

5 JLL Research, STR

6 Annual income statements for five of the largest U.S. hotel and resort REITs (Host Hotels & Resorts, Inc., Ryman Hospitality Properties, Inc., Apple Hospitality REIT, Inc., Park Hotels & Resorts Inc., Sunstone Hotel Investors, Inc.) and five of the largest U.S. hotel and resort operators/franchisors (Marriott International, Inc., Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation, Choice Hotels International, Inc., Wyndham Hotels & Resorts, Inc.).

This report is for informational purposes only, and does not constitute an offer to sell, or the solicitation of an offer to buy, any interest or investment in the Fund. Past performance is not a guarantee of future results.

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”