We are Hiring! Click here to see our open positions.

Office Space Oddity

calendar_today June 7, 2023

By Frank A. Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners

and Anton W. Golding, Associate, Fund Manager Analyst. PPB Capital Partners

After a multi-year push for a “return to office” for employees, many have found work-from-home and hybrid accommodations to be a sticky benefit, with office landlords and investors feeling the brunt of this societal change.

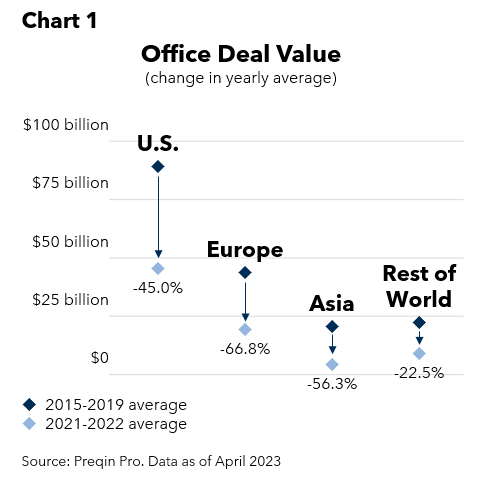

The average office deal value in the U.S. has dropped by almost 50% since before the pandemic (Chart 1), with declines across all major metropolitan areas. Combined with higher interest rates, this once stable property type is now facing significant uncertainty and volatility regarding occupancy, revenue and valuation.

Does this confluence of timing and circumstance present investors with opportunity? Or should they consider other property types as they build their real estate portfolios?

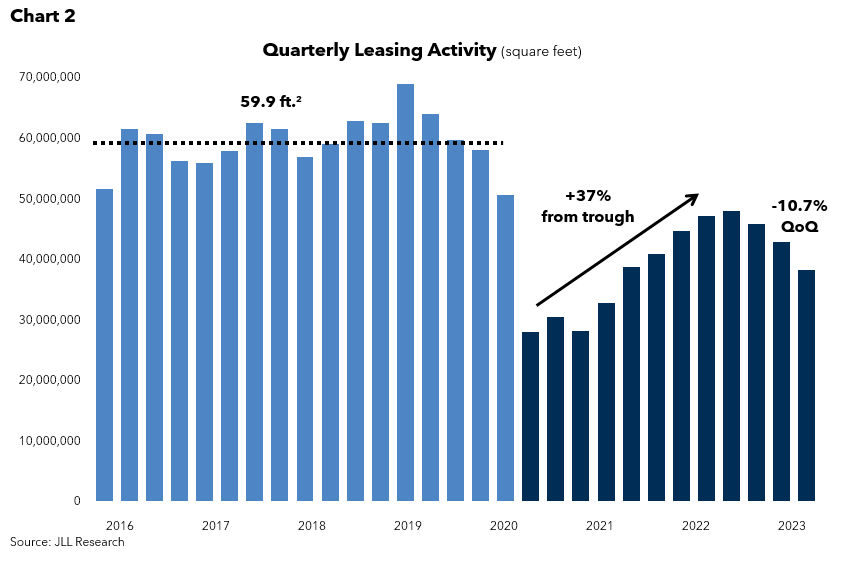

While office leasing space was on its way to recovery after several years, quarterly leasing activity has seen steep declines for the past three quarters, as illustrated in Chart 2. Leasing activity by square feet in the first quarter of 2023 sits at less than 64% of the pre-pandemic average.1

Under Pressure

Despite the recent decline in leasing activity, many companies with large workforces continue to roll out return-to-office policies, which have helped push the Kastle workplace occupancy index beyond 50% for the first time since the pandemic.2 Without question, the upward momentum of the index is a positive note.

However, the full picture is far more complicated. Many major cities are only halfway back to pre-pandemic daily occupancy levels, and in several metro areas these levels appear to be slowing in growth.

The concept of a hybrid work policy has been magnified. While some employers may have experimented with work-from-home and hybrid policies before 2020, the mandated at-home work environment accelerated its growth. And in many cases, it has certainly become the norm. A deeper dive into the data reveals a major divergence between what are currently the highest- and lowest-occupied days of the week: 57.6% (Tuesday) and 32.4% (Friday).2 This would imply hybrid policies continue to expand. While these data points highlight the commitment by many companies to embrace the creation of a better employee experience, it places doubt on the widespread implementation of pre-pandemic, full-week, in-office policies.

Not surprisingly, the empty office space has not gone unnoticed by landlords. To counteract, they are doing all they can to attract signers to long-term leases. In return for the long-term ask, the leases are now being peppered with tenant-enticing concessions.

- Asking rental rates have been relatively stagnant, up just 1% YoY

- Tenant improvement allowance is up 5% YoY

- Free months are up 11% YoY, with landlords giving away nearly 10 months for free over the course of a 10-year lease1

The Rise and Fall

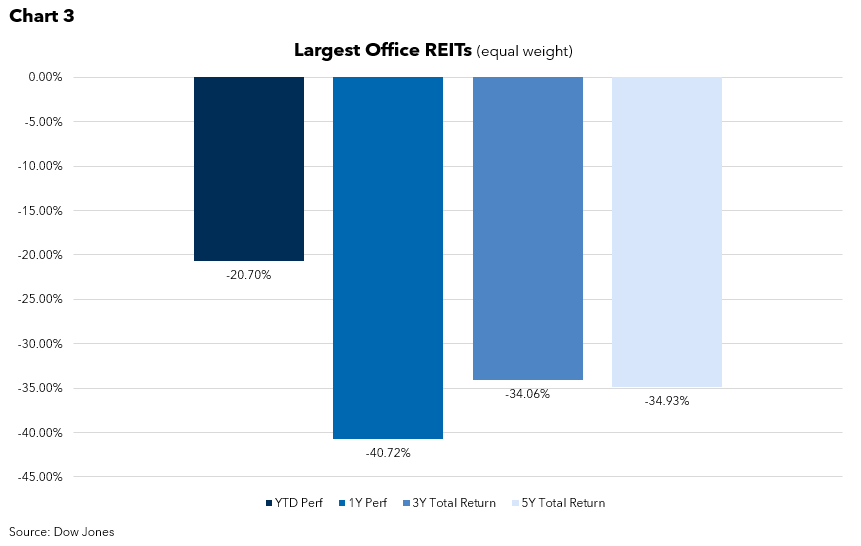

Since the onset of the pandemic, office REITs have not recovered and are down an additional 20% so far this year (see Chart 3). Despite attractive yields in the high single digits or even the mid to high teens, many office REITs are paying out dividends far exceeding current income. If headwinds persist, these high payouts may be slashed or suspended all together.

The critical question investors must ask themselves: is this an opportunity or the new reality?

Though occupancy rates and work-in-office trends are heading in a favorable direction for office landlords, the stickiness of work-from-home and hybrid policies, as highlighted earlier, may be much more persistent than they might hope for. They might, perhaps, even be permanent.

Considering this, investors may wish to look elsewhere to balance their real estate exposure. As we have highlighted in a few of our previous market updates, “There’s No Place Like Home” and “Break on Through (to the Other Side),” multifamily and hospitality properties offer resilient sources of growth and income and are benefiting from strong macro tailwinds.

In the end, an investor’s best chance of success across all asset classes falls upon finding managers with defined expertise, aligned investment principles and building a portfolio through a holistic lens.

Important Disclosures

1. https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/jll-us-office-outlook-q1-2023.pdf

2. https://www.kastle.com/safety-wellness/getting-america-back-to-work/

Additional source: https://www.preqin.com/insights/research/research-notes/once-the-hot-property-in-real-estate-offices-are-at-a-crossroads

This report is for informational purposes only, and does not constitute an offer to sell, or the solicitation of an offer to buy, any interest or investment in the Fund. Past performance is not a guarantee of future results.

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

Disclosure: Information presented is for educational purposes only, are subject to change from time to time and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”