We are Hiring! Click here to see our open positions.

Across the Pond

calendar_today February 23, 2024

Real Estate Bust. Right time, wrong place.

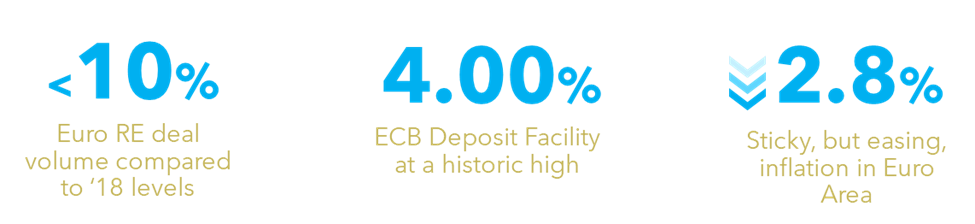

Analysts and journalists have long been discussing the impending commercial real estate collapse in the US. However, European deals have already fallen off a cliff in both value and volume. Significant and sticky inflation caused the implementation of aggressive monetary policy that has essentially brought the real estate market to a halt.

Opportunistic investors are left with a chance to capitalize on undervalued or untapped European assets. In this paper, we hone in on one area of interest, European hospitality assets. Here’s why:

- Hotel value and expansion. Tourism around the world is back. Reaching nearly 2019 highs, 2023 brought more than 700 million travelers to Europe.

- Undervalued residential real estate. The highly fragmented nature present in certain rental properties can be rip for opportunistic investors.

- Spectacular entertainment. Europe is set to host various events including the Olympics, UEFA Euro, Taylor Swift, Bruce Springsteen, and Metallica to name a few. Such spectacles will undoubtedly aid the tourism sector.

Evaluating real estate exposure at an opportune time

As you think about ways to bring diversification and income to your clients’ portfolios, often untapped and overlooked market sectors surface to add value. That’s why it’s critical to ensure your manager research process leaves no stone unturned and is highly in tune with policies that can bring benefits for opportunistic investors.

Incorporating boutique or niche managers allow for uncorrelated returns, and in turn, downside risk protection in ways you might not have considered. Simply buying a distressed property in Europe can limit full potential. Investors need to look for high-quality assets that have been squeezed, like hospitality.

“Opportunistic investors can take advantage of the current stressed market environment to buy quality assets from owners with bad balance sheets.” – Anton Golding, Director, Investment Strategist, PPB Capital Partners. Ask Anton a question.

Term definitions – ECB: European Central Bank, RevPAR: Revenue per available room

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”