We are Hiring! Click here to see our open positions.

Judge for Yourself

calendar_today July 12, 2023

By Frank A. Burke, CFA, CAIA, Chief Investment Officer

and

Anton W. Golding, Associate, Fund Manager Analyst

PPB Capital Partners

Regular readers of PPB’s monthly insights know that we are big fans of Charles Dickens, as clearly illustrated in the title of our February market update. Dickens always had something clever to say about everything (which is only part of what made him so great), and legal proceedings are no different.

In The Curiosity Shop, Dickens writes:

“If there were no bad people, there would be no good lawyers.”

If we may paraphrase a quote so authentic to tee up a conversation about the fascinating and impactful asset class of litigation finance:

“If there were no good financiers, there would be less opportunities for justice.”

A true alternative investment even by today’s standard, litigation finance can aid legal proceedings that require significant capital and resources while offering investors high yield income and uncorrelated returns. While sometimes an expensive form of financing, these private investments allow cases to proceed when they otherwise might run out of steam.

Facts of the Case

Opportunities in litigation finance (or “LitFin” for short) are typically categorized by the type of litigation (e.g., commercial, mass tort, international arbitration, etc.) and how the financing is structured, which typically is in the form of a loan directly to a law firm, or by lending against a specific case or docket.

For many years, regulations have placed restrictions on the types of financing available to law firms. These were enacted to prevent what would become an abject perversion of the legal system, which lies at the core of a functioning liberal democracy.

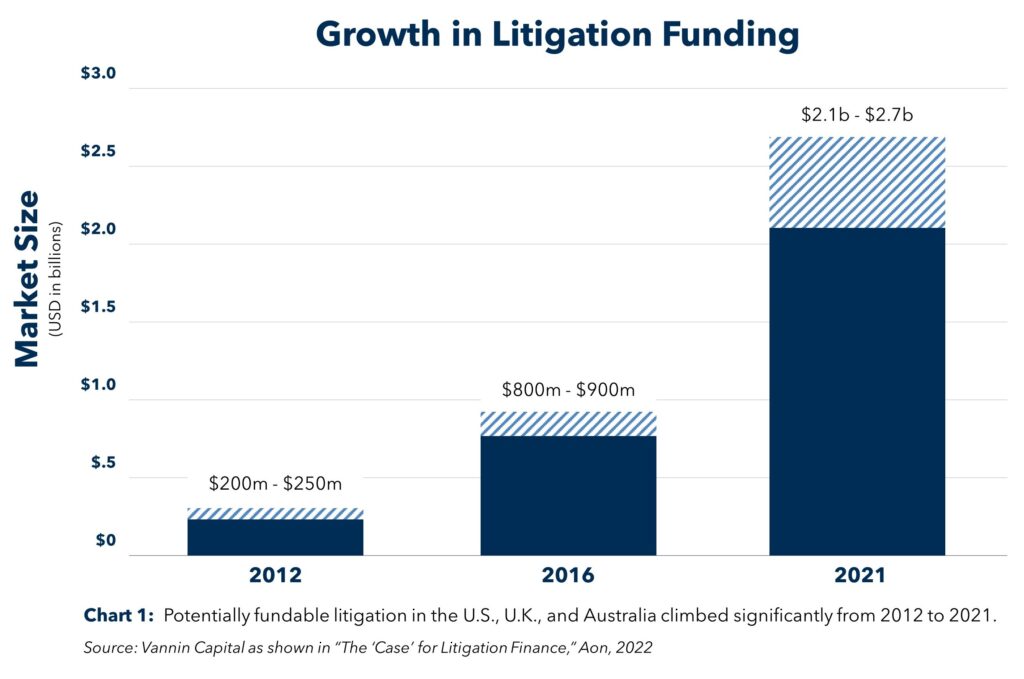

Throughout the life of a case, however, firms will incur considerable expenses which are expected to be fully recovered by the damages awarded through a favorable verdict. This is commonly known as “No Win No Fee.” Law firms do not have access to funding from traditional capital markets like many businesses. When combining that with the apprehension of banks to take on case/docket-backed loans, there is a dearth of capital-infusion opportunities in capital intensive cases. While still a heavily regulated industry, restrictions on financing for law firms have loosened in recent years. Limited access to capital combined with this decreased regulation has led to an explosion of private market litigation financing, with a +10x expansion in the market from 2012 to 2021 (see Chart 1)1. Despite this growth, LitFin is still an incredibly small market—relative to other alternative strategies. Considering the nuances of this niche market, LitFin investments have a certain level of inherent risk that requires expert hands to navigate.

While some pundits may question whether it is a societal positive to further integrate private investing with our courts, many see this free flow of capital having the same effect as efficient capital markets. Without funding, victims of wrongdoing may have difficulty seeking justice or bad actors may not face the appropriate repercussions of their actions.

Admissible Evidence

Now that we have completed our LitFin 101 course, it will pay to recall some fundamentals from Econ 101: supply and demand.

Looking at LitFin in a vacuum, the number of law firms seeking financing (demand) is disproportionate to the number of institutions willing to underwrite loans (supply). As we learned in our university lecture halls, low supply and high demand result in higher prices for that service. Considering the current dynamics of this niche market, the cost of receiving litigation financing is typically much higher than other industries. Such a dynamic will likely exist for years to come as regulations are still tight, potentially creating opportunities for investors.

The terms of litigation financing can depend on many factors, one of the most important of which is the stage of the case’s lifecycle. Much like traditional fixed income offerings (in a healthy market), longer-dated loans typically have higher interest rates. Rates associated with LitFin, regardless of duration, are likely to be higher than traditional counterparts. Even as the Fed continues monetary tightening making some alternative income sources less attractive, litigation financing terms have benefited with yields that maintain investor appeal.

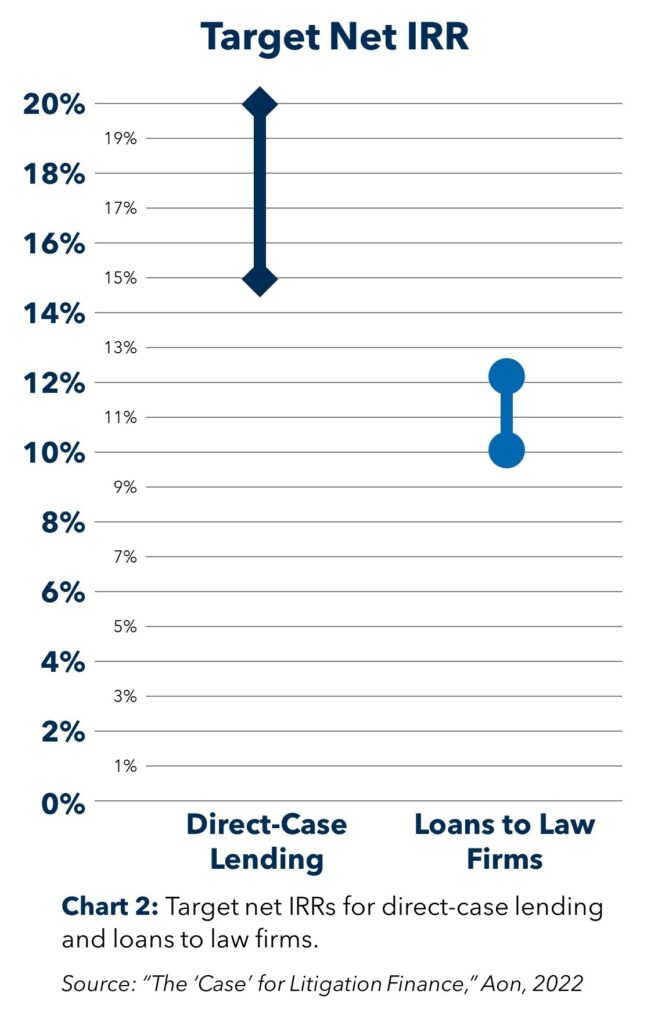

Apart from interest rates, investments in the LitFin space have little correlation to public markets and offer diversification in the truest sense. Bull market or bear, boom or bust, the courts will remain open, and firms will continue to require capital as they seek justice for their clients. Despite the relatively small market for litigation finance, there remains a wide variety of strategies that may complement either portfolio’s risk-on and growth investments or diversify an income-focused allocation. Funds focused on the early stages of cases—where the outcome is unknown—may have risk profiles similar to those often found in venture capital. Other strategies can take a more risk-adjusted approach by refinancing late-lifecycle cases where outcomes are known or when settlements are in process. As with all investments, the tradeoff for lower risk opportunities is the potential for lower returns. While performance data is relatively scarce, research from Aon indicates target net IRRs for direct case lending and loans to law firms range from 15-20% and 10-12%, respectively (Chart 2).

Despite all of this, no matter the stage of investment, litigation finance may be a valued component in an allocator’s private market sleeve. In the truest sense, litigation finance may provide investors with diversification and uncorrelated returns.

Footnotes and Important Disclosures

1 “The ‘Case’ for Litigation Finance,” Aon, 2022 (https://insights-north-america.aon.com/investment/aon-thecaseforlitigationfinance-whitepaper)

Additional sources:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3751369

This report is for informational purposes only, and does not constitute an offer to sell, or the solicitation of an offer to buy, any interest or investment in the Fund. Past performance is not a guarantee of future results.

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

Disclosure: Information presented is for educational purposes only, are subject to change from time to time and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”