We are Hiring! Click here to see our open positions.

“There’s No Place Like Home…”

calendar_today March 3, 2023

By Frank A. Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners

and

Anton W. Golding, Fund Manager Analyst, PPB Capital Partners

Thanks to a little nudge from Glinda, the Good Witch of the North, it seems that Dorothy was onto something. With real estate prices soaring, much like Dorothy’s home in that famous Kansas twister, and rates threatening market stability, investors must examine all opportunities and risks that are present today.

Recent Developments

When COVID-19 first arrived in the United States in 2020, panic ensued as daily life was upended by lockdowns, quarantines, travel restrictions and on and on. Global financial markets plummeted as investors were overwhelmed by the uncertainty surrounding the businesses and economy, with the VIX index reaching its highest levels in more than a decade.1 Such an extraordinary event was followed by an equally dramatic and unwavering bull run in public and private markets as American enterprise proved resilient and adaptive.

The post-COVID bull market grabbed a hold of everything in its wake, from high-flying growth companies and large brand businesses to bankrupt retailers and obscure crypto assets. While some families may have hosted a newly minted day trading “expert” at the Thanksgiving table, almost everyone knows someone who tried to buy or sell a home in the hottest real estate market since the Great Financial Crisis.

In response to market panic and to encourage economic participation, the Federal Reserve dropped the Fed Funds rates to 0-0.25% and flooded the market with trillions of dollars, attempting to ensure liquidity and confidence in the financial system.2 Further, federal and state governments enacted massive stimulus programs in hopes of bolstering consumer balance sheets, protecting payrolls and keeping the economy moving forward.

With robust savings, the U.S. saw a large-scale push by millennials and young families from dense urban centers moving into the suburbs. Initial lockdowns and subsequent opportunities for remote work led to many trading in their studio and one-bedroom apartments for single family homes with additional dedicated space in more affordable areas. As a result of this generational shift, news stories and anecdotes of homes being sold for hundreds of thousands of dollars above asking price polluted the airways.

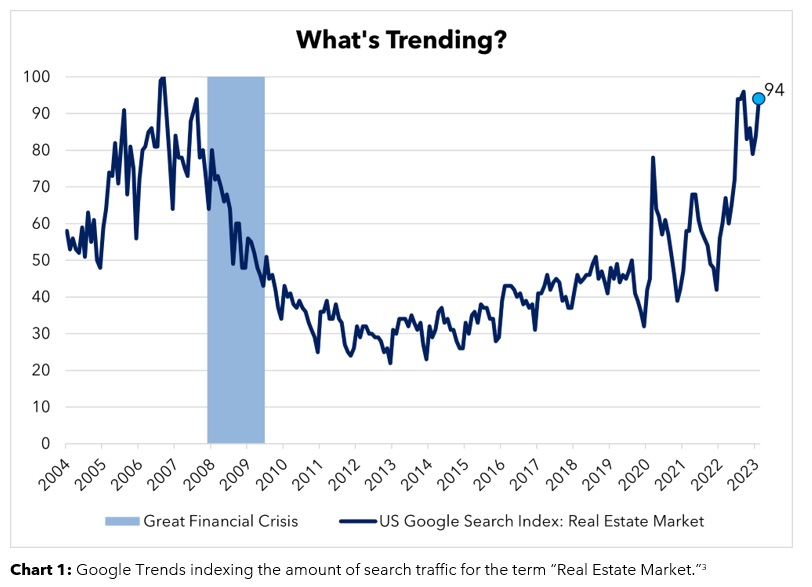

A quick look at Chart 1, a snapshot of the Google Search Index for the phrase “Real Estate Market” since 2004, illustrates the hold real estate had on the public. Searches for information about real estate spiked to levels not seen since the period prior to the Great Financial Crisis.

Considering the recent run up in home prices, as well as the new regime of higher interest rates meant to quash inflation, investors should be asking themselves “what’s next for residential real estate?”

The Bear Case

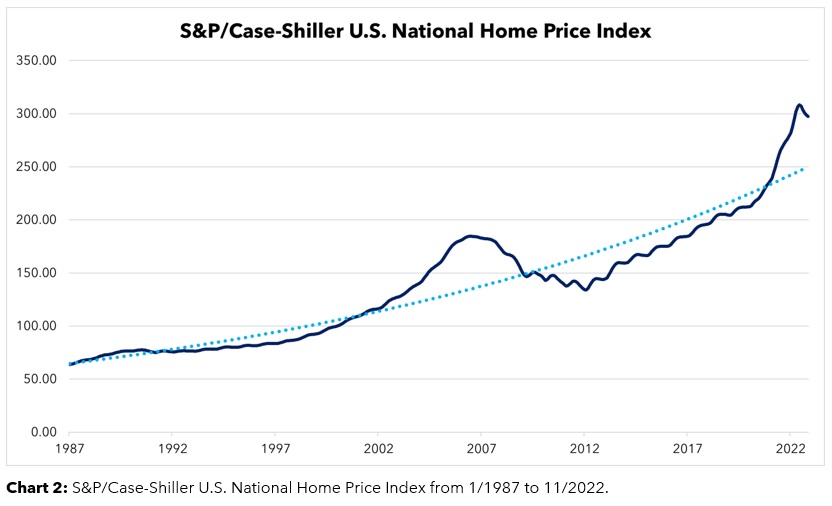

There is no doubt that the residential real estate market benefited greatly from the circumstances listed above. From January 2020 to its high in June 2022, the S&P/Case-Shiller U.S. National Home Price Index advanced 45%.4 As of November 2022 (latest available data), the index has pulled back more than 3.5% with many analysts expecting continued declines. As it stands, the index price remains significantly above the long-term exponential trend, as seen in Chart 2.

Considering the state of the homebuyer, it’s prudent to be weary of negative trends of consumer balance sheets. Credit card loan delinquency rates have been ticking up to pre-COVID levels, and personal savings levels have reached decade-long lows. Essentially, if government stimulus was the music, the public kept dancing long after it stopped playing.

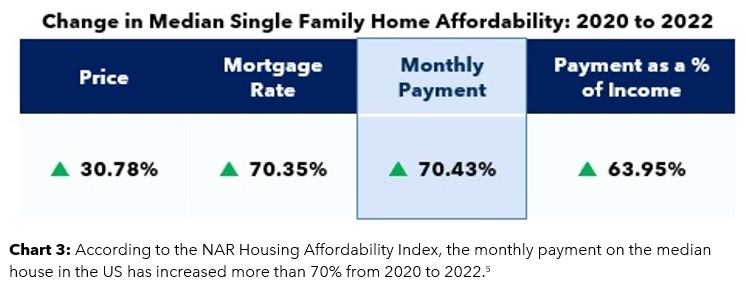

Since the start of the pandemic, the rate environment and strength of the consumer has changed dramatically, significantly impacting purchasing power and subsequent market pricing. To understand the combined shock of rising home prices and rates on affordability, see Chart 3 for the full scope.

With prices as they are, consumers and real estate investors will be less willing to take on the risks of new projects, potentially leading to a significant repricing of the residential real estate market. Keeping the Oz-inspired name of the article in mind, near-term investors must be prudent when allocating to residential real estate, lest they be crushed by high-flying home prices.

The Bull Case

While the recent regime of rising rates has certainly slowed transaction volumes and price appreciation, the long-term environment and supply/demand imbalance lends itself to a robust residential real estate market.

Since the Great Recession and implosion of the U.S. housing market, home builders significantly cut back new construction. There were fewer homes constructed from 2008 to 2018 than during any decade since 1960, despite the population being twice the size. While analysts expect demand to slow, the severe supply shortage is expected to persist, with middle- to lower-income households feeling the brunt of the rising unaffordability levels (as highlighted in Chart 3). According to Freddie Mac, in 2020 there was an estimated shortage of 3.8 million housing units for sale or rent, up from 2.5 million in 2018.6

While this increased shortage may have been exacerbated by the pandemic, long standing issues including construction labor availability, land use and zoning restrictions, and lack of developer activity are the primary, abiding factors. Considering the low supply levels, particularly in workforce and affordable housing, private funds and developers should benefit from these persistent issues, particularly when prices stabilize and demand inevitably picks up.

While many may see today’s interest rates as an incredibly high, or even hazardous, barrier for new investments in real estate, it also creates a new set of opportunities. In his book Mastering the Market Cycle, Howard Marks recalls the “steel skeletons” of the Wilshire corridor in Los Angeles. Overextended developers and investors who initiated projects in the 1970s were hit hard by the Volcker-led Fed rate hikes, which peaked at around 20%. While some viewed rates as an impossible barrier to cross, savvy investors purchased these projects for massive discounts.

Today, we see a similar set of opportunities occurring as overextended real estate investors caught off-guard by rising rates and have been unable to refinance sufficiently. As such, distressed and opportunistic real estate funds will potentially be able to purchase assets at discounts, creating long-term value for investors in a relatively high-rate environment.

Public vs. Private Markets

For some investors, there is no need to look further than publicly traded REITS for residential real estate exposure. However, for many private wealth advisors and their clients, private real estate funds offer opportunities to create more customized and mandate-specific portfolios.

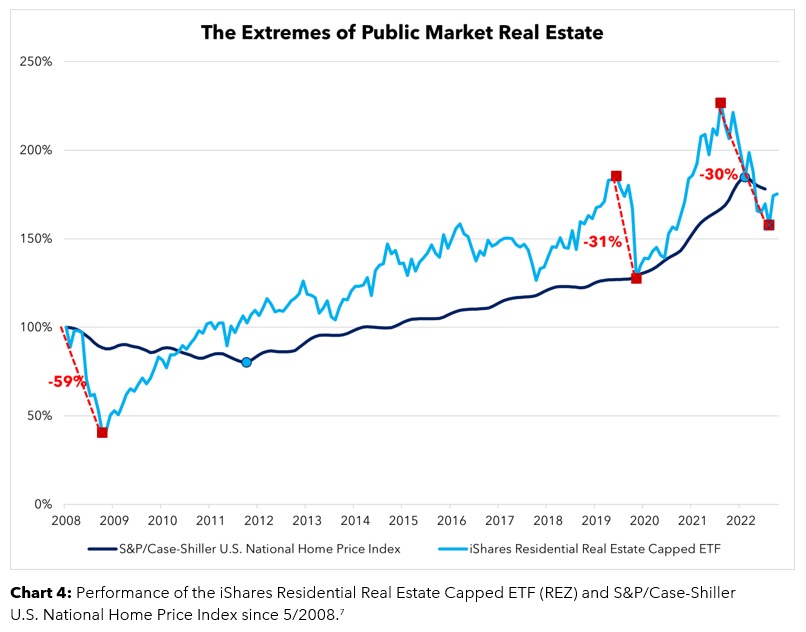

Given the inherent long-term nature of real estate, private funds give investors the proper exposure without being susceptible to the ups and downs of public markets. In Chart 4, we see how market sentiment creates great volatility, even in a relatively stable asset class like residential real estate. Since 2008, the iShares Residential Real Estate Capped ETF has had three significant corrections of 30% or greater, while the national home price index has been far steadier. The argument can be made that during these corrections are perfect opportunities to buy in. However, it’s common that many investors fall victim to their own emotions in the moment. The illiquid nature of private fund structures aligns well with the needed long-term mindset for investing in residential real estate.

Looking Forward to Getting Back Home

There are still attractive avenues for private wealth advisors and their clients to invest in residential real estate despite the obstacles of the current macro environment—whether it be through opportunistic and distressed funds or through workforce and affordable housing development. The key is to find a manager whose strategy and mandate are clear, aligned and have shown an ability to make sensible decisions in difficult times.

Footnotes and Important Disclosures

- CBOE and S&P Dow Jones Indices, a Division of S&P Global https://www.spglobal.com/spdji/en/vix-intro/

- Federal Reserve Economic Data (FRED) https://fred.stlouisfed.org/series/FEDFUNDS

- Google Trends https://trends.google.com/trends/explore?date=all&geo=US&q=Real%20Estate%20Market

- S&P Global https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/sp-corelogic-case-shiller-composite/#indices

- National Association of Realtors https://www.nar.realtor/research-and-statistics/housing-statistics/housing-affordability-index

- Freddie Mac https://www.freddiemac.com/research/insight/20210507-housing-supply

- BlackRock, S&P Global https://www.ishares.com/us/products/239545/ishares-residential-and-multisector-real-estate-etf, https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/sp-corelogic-case-shiller-composite/#indices

This report is for informational purposes only, and does not constitute an offer to sell, or the solicitation of an offer to buy, any interest or investment in the Fund. Past performance is not a guarantee of future results.

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”