We are Hiring! Click here to see our open positions.

“It was the Best of Markets . . .”

calendar_today February 3, 2023

By Frank A. Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners

and

Anton W. Golding, Fund Manager Analyst, PPB Capital Partners

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.”

— Charles Dickens, A Tale of Two Cities

If there was ever an appropriate allusion for 2022 capital markets, it would be Dickens’ famous introduction to A Tale of Two Cities. Some managers’ returns were going direct to Heaven, and many went direct the other way. Mega funds—including Citadel, Millennium, Point72 and D.E. Shaw—claimed their place on the throne in 2022, delivering double digit returns and returns billions of dollars of profit to their investors. However, despite many hedge funds experiencing a season of Light, particularly these mega funds, news headlines continue to bash the asset class.

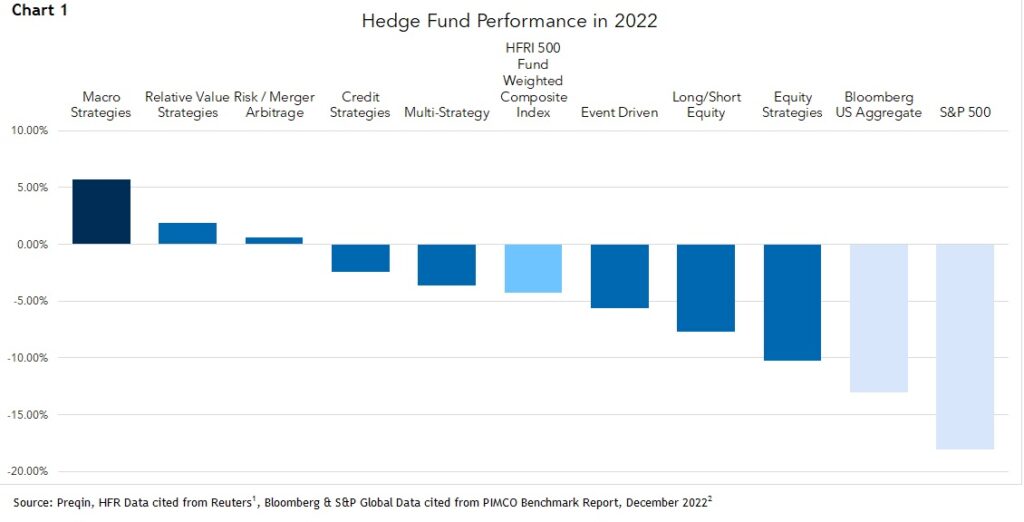

For years now, the value of hedge funds has been questioned by critics and allocators: “Why pay hefty fees for underperformance? They can’t even beat the market!” Even this month, many financial media outlets have attempted to paint hedgies as overpaid underperformers. Headlines highlighting the dollar value of hedge fund losses are often an attempt to catch a reader’s attention but may be misleading and ignore the amount of capital that evaporated in 2022 by traditional strategies. The fact of the matter is the HFRI 500 Fund Weighted Composite Index outperformed the S&P 500 by nearly 1,400 bps and the Bloomberg Aggregate by nearly 900 bps (highlighted in Chart 1). Though the index did not deliver strong absolute returns for the year, (returning -4.25%) hedge funds clearly buoyed portfolios in a difficult 2022. Hedge funds, of course, will not replace core equity or bond allocations, but they are great at doing as their name suggests: hedging a portfolio in volatile markets.

While the entire hedge fund industry performed relatively well, macro strategies ran farther ahead of the pack in 2022, returning a solid 5.71%. Macro hedge funds, which make bets based on global political and economic events, took advantage of sliding valuations, rising rates, and increased volatility across equity, fixed income, commodity and foreign exchange markets. Such strategies outperformed traditional long/short equity at -7.16%, which benefited from those same conditions that created a stock picker’s market, but to a much lesser extent as many funds decreased their short books in recent years3.

From the Russian invasion of Ukraine, contentious elections in Brazil and attempts to quell inflation by central banks, portfolio managers have had a plethora of global opportunities for diverse and profitable bets. Such uncertainty led to a wide range of performance across all asset classes and sectors. When considering just US large cap stocks, we saw immense sector dispersion in the S&P 500 with the energy sector returning more than 30% at the top and communications services sector losing approximately 40% of its value. This created countless opportunities for active managers to break from the herd. This is further evidenced by the lowest number of positive trading days in more than a decade4. Accompanied with the geopolitical issues, 2022 was a dream environment for stock pickers, short sellers and macro traders.

We expect market volatility to continue into 2023, though possibly to a lesser extent, as macro risks continue to unfold. The following situations are just a few macro situations to keep an eye on this year:

- Inflation and central bank policy

- Russian invasion of Ukraine, European recession

- China: Xi Jinping, economic reopening and Taiwan tensions

- US debt crisis, Congressional gridlock

- Growing political unrest in South America

Not All Funds are Created Equal

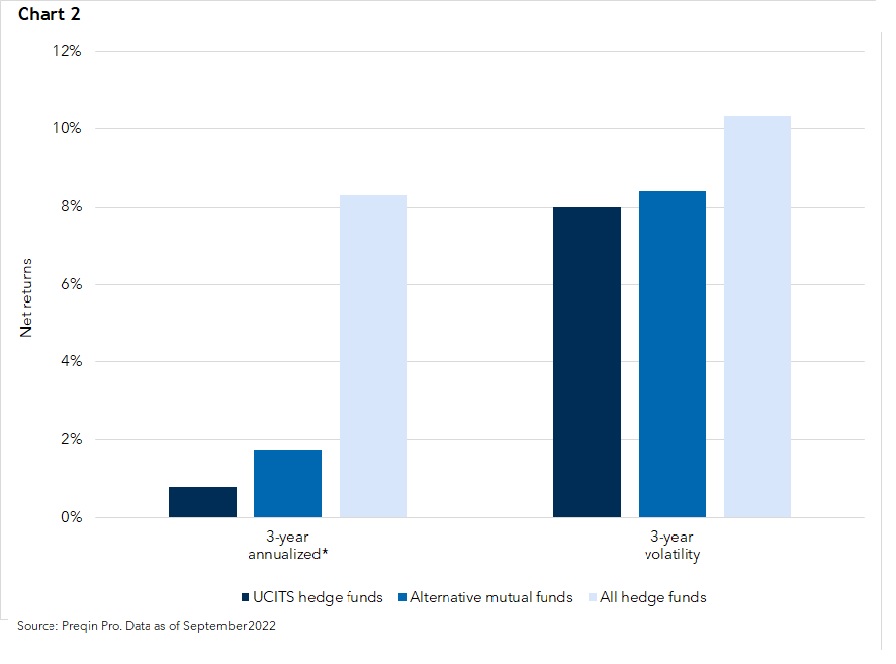

While hedge funds as an asset class have done well in recent market environments, not all funds are created equal. To reach a wider audience of investors, many fund providers have expanded their liquid alts offerings to solve for liquidity and accessibility issues in the industry. While these problems may be addressed with more regular liquidity and low minimums, liquid alts in the form of mutual funds and UCITS have not been able to keep up with industry returns.

In Chart 2, we see that alternative mutual fund and UCITS hedge fund returns have paled in comparison to the overall industry while maintaining similar volatility levels. This comes from high liquidity requirements, thereby shrinking the investable universe as well as the number of opportunities for outperformance. Traditional hedge funds, which provide less regular liquidity, can build positions in lesser-traded securities where market inefficiencies are more likely to occur and alpha may be unlocked.

With the specter of continued market volatility looming for the foreseeable future, we see the current environment lending itself to continued performance by the hedge fund industry. It is imperative to understand that all hedge funds have different mandates and purposes, which may lead to highly varied results. Understanding this, wealth advisors and their clients should construct alternative investment portfolios that are customized to best fit their needs and goals. Knowing this, advisors may be able to use hedge funds to balance portfolios and weather the current regime of market volatility.

Footnotes and Important Disclosures

2 PIMCO Benchmark Report, December 2022

3 Preqin

4 https://www.schwab.com/learn/story/top-global-risks-2023

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto.

The underlying Fund information discussed or included in the segments of private equity discussed, represents that of Private entities which are not required to file with Preqin. The data given in this document is composed of all data that has been filed with Preqin but is not comprised of the information from every Private Equity Fund. .

Certain securities offered through Registered Representative with Vigilant Distributors LLC (Member FINRA/SIPC), which is not affiliated with PPB Capital Partners or its affiliates.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”