We are Hiring! Click here to see our open positions.

Trends in Workforce Housing Post COVID-19

calendar_today October 12, 2020

As market volatility picks up before the election, wealth advisors continue to seek out uncorrelated return streams and new sources of income. Real estate investing has brought many of these solutions in the past, but the pandemic has created a bifurcated real estate market.

With record low interest rates, the residential housing sector is booming, particularly in the medium to higher-end price points. In particular, suburban real estate prices are soaring, as more people move out of urban centers creating more demand and current inventory levels are limited. In contrast, the hospitality sector and office space remain under stress as the long-term implications of COVID-19 remain unknown.

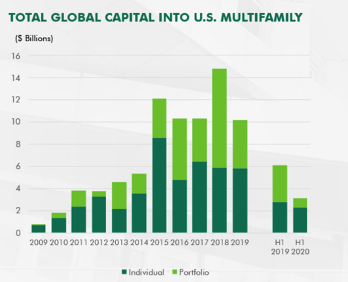

Within residential real estate there is further bifurcation as global capital flowing into multifamily is down almost 50% year over year for the first half of 2020.1 (CBRE Chart)

While most larger investors have focused on urban centers and Class A properties historically, workforce housing has remained an underserviced segment of the multifamily market. Workforce housing is defined as housing that is affordable to households earning 60% to 120% of area median income (AMI). This segment of the market has historically been recession-proof, which was demonstrated during the last recession in 2008. Properties maintained high occupancy rates as the renters were renting by necessity, not choice.

Despite the stability in this segment, there has been a significant shortage of workforce housing available as most new development has focused on properties generating higher rents per unit. Less than 3% of all newly developed apartments over the last decade are considered affordable to AMI earners. As renters continue to move out of pricier units due to the pandemic and its implications on families worldwide, vacancy rates in workforce housing are at 20-year lows.

Because most institutional investors and the larger public REITs are focused on bigger properties in major cities which command higher rents, many larger allocators are underweight workforce housing and have limited opportunities to access this subset of the multifamily market.

We believe investors would be wise to look for smaller, more nimble managers to fill workforce housing mandates. These fund managers are well positioned to deliver stable income to investors. While cap rates have continued to compress, the record interest rate environment has kept rent spreads at attractive levels. Workforce housing remains a compelling investment, especially as investors ponder the direction of the public markets and move beyond traditional fixed income in their search for yield.

For more information on how to access dedicated workforce, multifamily real estate strategies, please contact Frank Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners, 484.278.4017 Ext. 108

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”