We are Hiring! Click here to see our open positions.

The Growth and Opportunity in Private Credit and Lending

calendar_today November 16, 2020

Conshohocken, PA, November 16, 2020 – With a vaccine on the horizon and the election results seemingly known, the markets have rallied during the second week of November. However, Europe is about to enter another lockdown phase and positive COVID-19 cases have picked up substantially around Europe and the U.S. While another round of stimulus will be coming, the size and scale of that capital infusion will likely be significantly less than anticipated, especially if Congress remains divided. With this backdrop, companies remain under stress and the need for private capital is key to keeping them afloat.

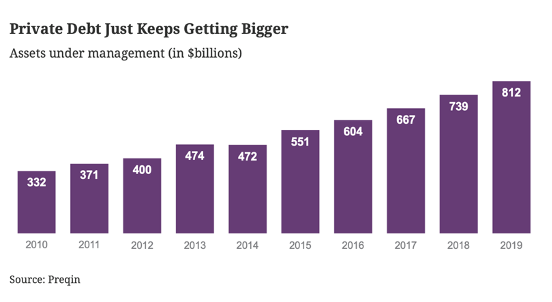

The credit market dislocation has created pricing, structures and terms that have not been present for the last ten years. In fact, the number of assets managed in private debt is up almost 2.5x since 2010 according to Preqin (see chart). The past decade has provided an easy backdrop for new players to come into the private credit universe, many of them smaller, boutique firms, who have been able to both make money and launch funds in one of the lowest default rate environments in history.

Accordingly, many of these smaller managers do not have the resources to manage their underlying investments while continuing to source new deals in a default rate environment that has changed dramatically. Defaults rates have spiked this year, especially in industries most impacted by the lockdowns such as travel, entertainment and restaurants. In addition, Standard & Poor’s Global sees default rates in the U.S. doubling by June 2021 to 12.5% from a preliminary estimate of 6.3%.1

Most importantly, the sourcing opportunity for private lending is now the most robust we have seen in over a decade from a structuring and term standpoint. Middle-market borrowing rates have risen appropriately, covenant-light deals have declined, and broader covenant terms have become stricter. In addition, spreads between private credit and more liquid credit names have continued to widen, as the Fed’s liquidity infusion into the markets have helped publicly traded credit positions rally, even as fundamentals remain weak or stressed. As investors remain starved for yield, private credit strategies, especially with a focus on direct lending, are poised to help solve investors’ income and return needs.

For this reason, PPB Capital Partners believes that larger private credit managers are poised to significantly outperform their peers over the next two years. Firms with dedicated asset management teams and separate sourcing groups will have substantial manpower advantages to navigate the distressed opportunities that are expected to develop. In addition, in the event of a resurgence in dislocation within the broadly syndicated loan market, larger firms with greater resources and financial stability will have the investment scale needed to capitalize on both these opportunities along with more niche and private corporate or asset-based lending situations.

For more information on how to access PPB’s dedicated private lending strategy, please contact Frank Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners, 484.278.4017 Ext. 108 or at fab@ppbadvisors.com.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Loyalty

- “It was the Best of Markets . . .”