The Essential Due Diligence

July 9, 2019

PPB works with fund sponsors of all sizes. When accessing our platform of managers, one of the key solutions that we provide advisors is third party due diligence reporting. This due diligence is essential, especially when introducing smaller, niche managers. PPB partners with Castle Hall to conduct an onsite review of our fund managers’ offices. Castle Hall then develops a full Operational Due Diligence review, as well as a separate Risk Report that analyzes all associated risks of the strategy and firm. We make both of these reports available as a beginning stage in the process of investing in our of our fund managers.

Many of our advisor partners rely on this due diligence when conducting their own analysis of an investment and whether it makes sense for their client portfolios. By having these independent reports as an available resource, we speed up the allocation process for the underlying manager. This allows the advisor to make an investment recommendation with more confidence. Many institutional investors outsource the Operational Due Diligence function, and Castle Hall has earned a strong reputation in the field. Among their clients are sovereign wealth funds, pension funds and endowments that comprise over 100 institutional investors from around the world.

Castle Hall has a worldwide team of 70 professionals and will only provide research – they don’t manage assets or provide investment advice. Based in Montreal, with offices arund the globe in Zurich, Manila, Abu Dhabi, and Sydney, Castle Hall has been an excellent partner of PPB Capital Partners. Fund sponsors and Advisory Firm allocators benefit from the high quality of service they provide.

For more information on due diligence amongst alternative investment strategies, please contact me.

Frank Burke, CFA, CAIA

Chief Investment Strategist, PPB Capital Partners

484.278.4017 Ext. 108

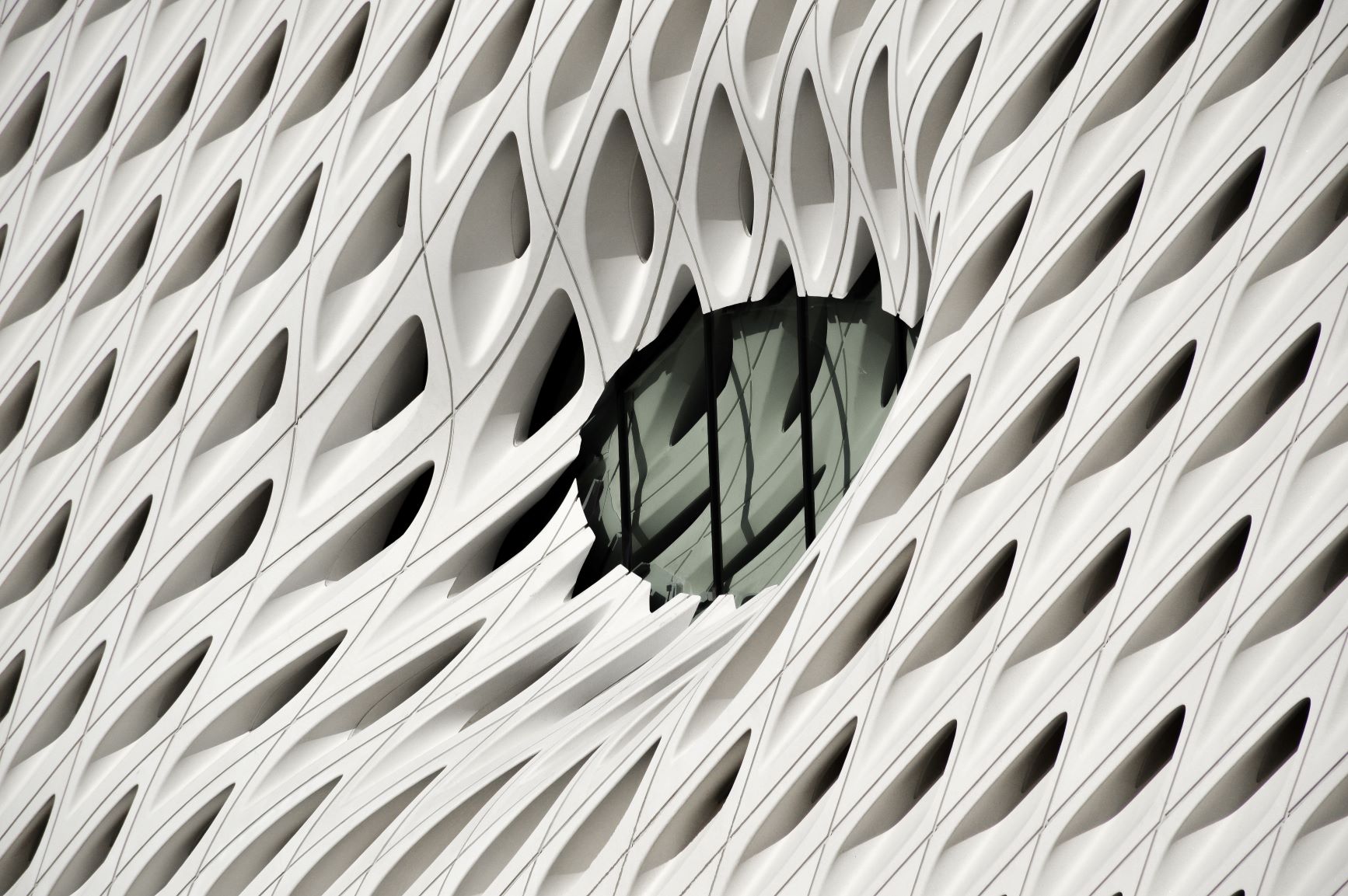

(Photo Credit: Photo by Tu Tram Pham on Unsplash)