Beyond The Whiplash

February 25, 2026

When markets move faster than fundamentals, even solid strategies can stumble. Today’s investment landscape is defined by turbulence. In a climate where public markets react more to headlines than earnings, the risk of sharp drawdowns is now a central concern. Investors seek clarity and consistency, and now is the time to reassess how—and where—returns are generated.

Equities are under pressure, and investors need to reshape their return strategies. Volatility driven by macroeconomic factors—rising interest rates, tariff tensions, and the rapidly evolving AI landscape—has made public markets increasingly vulnerable at today’s elevated valuations. The risk of major drawdowns is more pronounced than ever, making it harder to meet long-term return objectives with equities alone, especially in an overheated market.

Outpacing the Chaos: Private Markets at the Finish Line

When faced with heightened market risk and underperforming bonds, private market investments are not just an alternative, they’re an essential component of a modern, well-diversified portfolio. By integrating private market investments, investors gain exposure to uncorrelated return streams, mitigate risk, and enhance long-term performance in an ever-changing economic landscape.

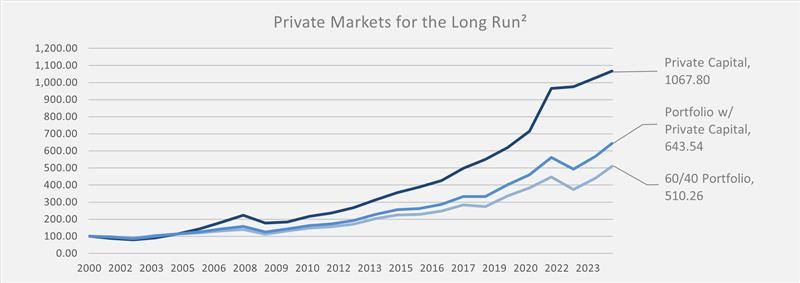

Data illustrates how private capital has significantly outperformed traditional portfolios over the past two decades, underscoring its growing role in long-term portfolio construction.

Private capital’s long-term performance edge makes a compelling case for its inclusion in portfolios aiming to weather volatility and drive sustained growth. In fact, portfolios including private capital substantially outperformed a traditional 60/40 allocation by over 10%.

What sets them apart?

Uncorrelated Returns – Private investments don’t move in lockstep with public markets, offering portfolio stability.

Enhanced Diversification – A mix of private assets helps reduce reliance on a single asset class, mitigating risk.

Attractive Income Streams – Private credit and other alternative assets provide consistent income in uncertain times.

Long-Term Growth Potential – Private equity and venture capital give access to early-stage and high-growth opportunities often unavailable in public markets.

A Strategic Shift for the Future

Since 2000, private capital has grown over 10x, reaching an indexed value of 1,067.80, far surpassing both traditional and blended portfolios. Now more than ever, investors need to think beyond traditional asset allocation. A well-balanced portfolio should integrate private markets as a core component, helping to hedge against public market downturns while unlocking new sources of income and growth.

Key Questions for Your Portfolio:

- Is your portfolio built to withstand major market dislocations?

- Are you positioned to capitalize on emerging megatrends?

- Have you considered private market assets for a more durable, diversified strategy?

At PPB, we specialize in delivering access to highly differentiated private market strategies designed to meet the evolving needs of investors. Whether you’re looking for stability, income, or long-term capital appreciation, private markets provide the flexibility and resilience needed in today’s economic climate.

A one-stop shop technology solution for RIAs does not exist, so why limit our firm and private wealth advisors to just one provider?

– Brendan Lake, Founder & CEO