White-Labeled, White-Knuckle

October 7, 2025

When Your Custom Fund Vision Hits Operational Reality

Customized private market funds, often delivered as white-labeled solutions, provide wealth advisors with a powerful avenue to offer institutional-caliber alternative investments while retaining brand identity. These funds can help differentiate an advisory practice and expand its investment offerings.

While attractive in concept, the execution of a custom, white-labeled fund introduces a series of significant operational challenges: complex administrative demands, variable costs, and human capital constraints. Understanding these realities is critical for advisors looking to scale efficiently and maintain focus on client relationships.

Capacity Strain: Why Advisors Hit a Ceiling

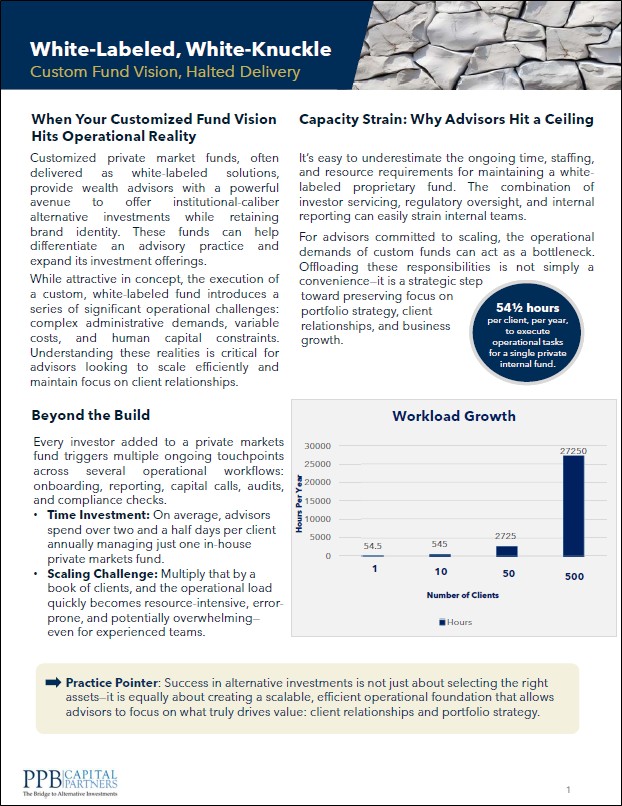

It’s easy to underestimate the ongoing time, staffing, and resource requirements for maintaining a white-labeled proprietary fund. The combination of investor servicing, regulatory oversight, and internal reporting can easily strain internal teams.

For advisors committed to scaling, the operational demands of custom funds can act as a bottleneck. Offloading these responsibilities is not simply a convenience—it is a strategic step toward preserving focus on portfolio strategy, client relationships, and business growth.

Here are a few questions to help you determine if streamlining your operational tasks is the right move for your firm:

- Is your firm’s operational infrastructure positioned to capitalize on the growing demand for sophisticated alternative investments?

- Are you exposed to the administrative friction that might divert your advisors from deeper client engagement and strategic portfolio construction?

- Have you considered whether offloading operational tasks could optimize your private market fund management?