The Growth and Opportunity in Private Credit and Lending

November 16, 2020

Conshohocken, PA, November 16, 2020 – With a vaccine on the horizon and the election results seemingly known, the markets have rallied during the second week of November. However, Europe is about to enter another lockdown phase and positive COVID-19 cases have picked up substantially around Europe and the U.S. While another round of stimulus will be coming, the size and scale of that capital infusion will likely be significantly less than anticipated, especially if Congress remains divided. With this backdrop, companies remain under stress and the need for private capital is key to keeping them afloat.

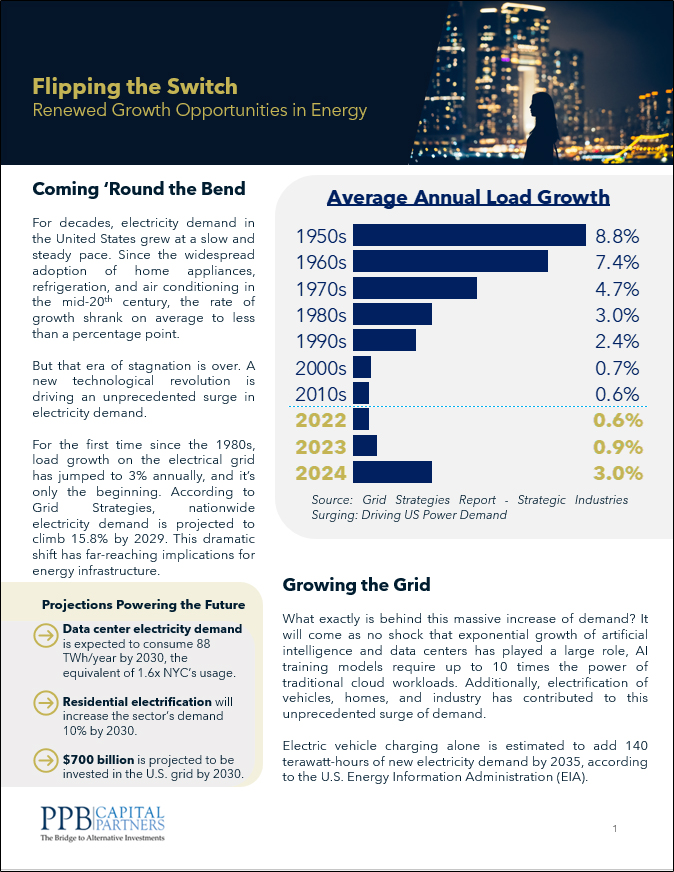

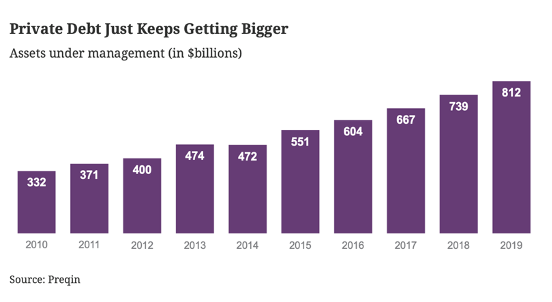

The credit market dislocation has created pricing, structures and terms that have not been present for the last ten years. In fact, the number of assets managed in private debt is up almost 2.5x since 2010 according to Preqin (see chart). The past decade has provided an easy backdrop for new players to come into the private credit universe, many of them smaller, boutique firms, who have been able to both make money and launch funds in one of the lowest default rate environments in history.

Accordingly, many of these smaller managers do not have the resources to manage their underlying investments while continuing to source new deals in a default rate environment that has changed dramatically. Defaults rates have spiked this year, especially in industries most impacted by the lockdowns such as travel, entertainment and restaurants. In addition, Standard & Poor’s Global sees default rates in the U.S. doubling by June 2021 to 12.5% from a preliminary estimate of 6.3%.1

Most importantly, the sourcing opportunity for private lending is now the most robust we have seen in over a decade from a structuring and term standpoint. Middle-market borrowing rates have risen appropriately, covenant-light deals have declined, and broader covenant terms have become stricter. In addition, spreads between private credit and more liquid credit names have continued to widen, as the Fed’s liquidity infusion into the markets have helped publicly traded credit positions rally, even as fundamentals remain weak or stressed. As investors remain starved for yield, private credit strategies, especially with a focus on direct lending, are poised to help solve investors’ income and return needs.

For this reason, PPB Capital Partners believes that larger private credit managers are poised to significantly outperform their peers over the next two years. Firms with dedicated asset management teams and separate sourcing groups will have substantial manpower advantages to navigate the distressed opportunities that are expected to develop. In addition, in the event of a resurgence in dislocation within the broadly syndicated loan market, larger firms with greater resources and financial stability will have the investment scale needed to capitalize on both these opportunities along with more niche and private corporate or asset-based lending situations.

For more information on how to access PPB’s dedicated private lending strategy, please contact Frank Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners, 484.278.4017 Ext. 108 or at [email protected].