Private Equity Strategies See Increased Inflows in 2021

April 13, 2021

Conshohocken, PA, April 13, 2021 – As we head into the second quarter and equity markets continue to test new highs, I am hearing more wealth advisors ask about Private Equity strategies. The universe of publicly traded listings continues to decline and assets flowing into the market continue to drive up prices, making traditional public equities expensive and less attractive.

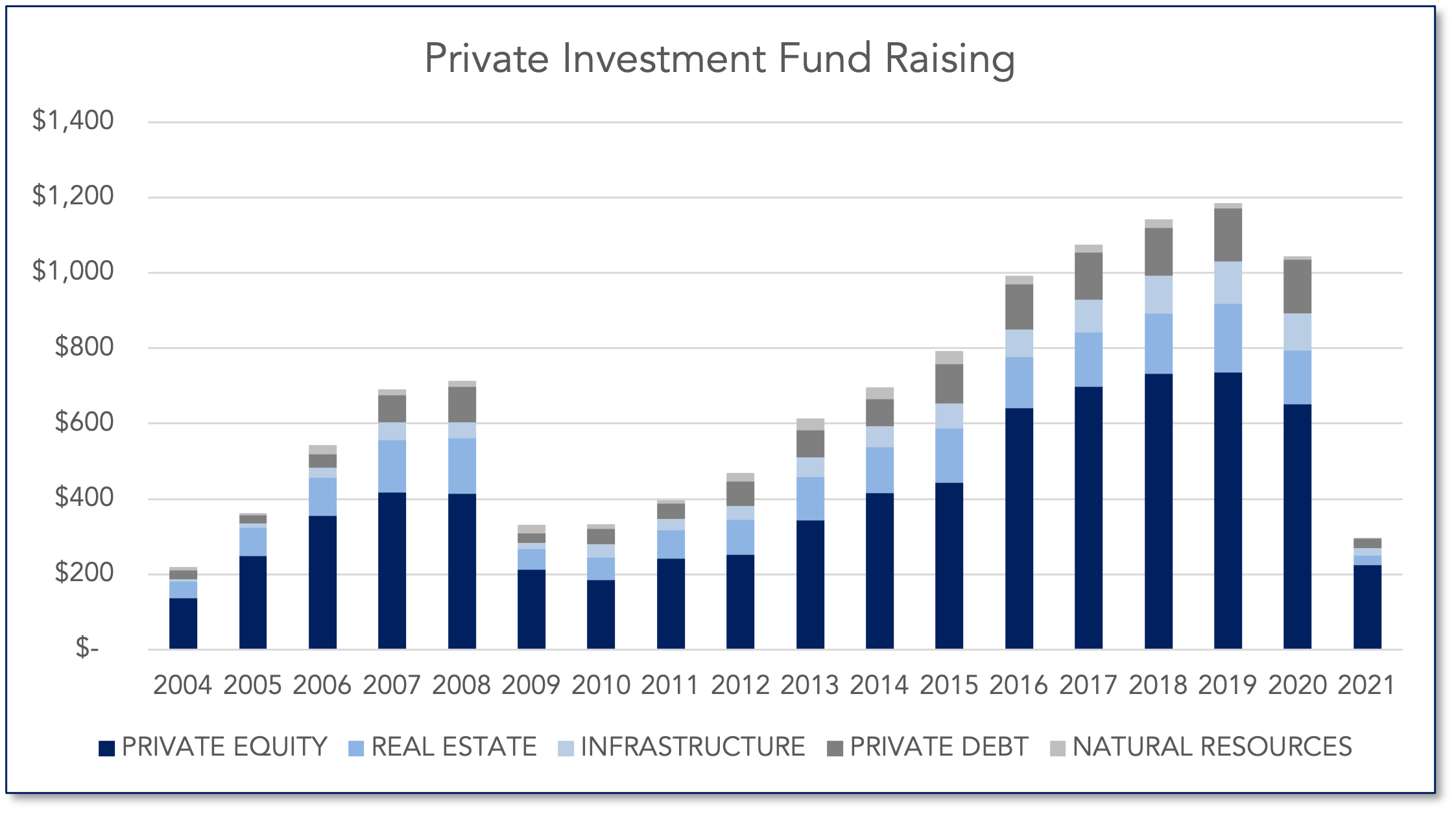

While 2020 saw an uptick in allocations to both real estate and credit strategies for yield starved investors during the pandemic, thus far in 2021 investors are turning to more growth-oriented investments. With cap-rates continuing to decline, investors have looked away from certain areas of real estate resulting in a drop in allocation percentage from 14% on average to 9%, while Private Debt dipped from 12% to 9%. Compelling opportunities in certain segments of the real estate market remain, such as workforce housing, but the lack of supply and low interest rate environment have pushed cap-rates down and valuations up across the strategy at large.

Private Equity is especially compelling for investors concerned about the volatility in financial markets. Since 2008, the annualized standard deviation of Private Equity strategies as measured by Preqin has been 8.4% compared to the S&P’s 17.7%. While the economy is seemlingly stabelizing and poised for a big rebound in growth, the overall increase in the stock market, especially as the world continues to manage its way out of the pandemic, has left some investors skeptical and looking for ways to manage around an expected uptick in volatility, especially as fundamentals start to matter again in valuations.

Private Equity can provide an important diversifier in client portfolios, but wealth advisors’ allocations will depend on each client’s liquidity needs and risk tolerance. Growth Equity is especially compelling in this environment with sectors such as technology and healthcare well positioned to remain sector leaders as many businesses in these areas (telemedicine, SaaS) saw their growth cycles significantly accelerate due to the pandemic. Accordingly, many wealth advisors are following the lead of institutional investors and adding to their allocations.

Investors should be cognizant of many of the same fundamental factors as public market investing when evaluating a Private Equity manager, including the amount of leverage employed and any industry specific or macro-economic risk factors. The biggest difference investors should consider is the lack of liquidity compared to public market investing, so knowing clients’ liquidity needs are paramount when considering these investments.

Private Equity offers attractive returns for investors in a less volatile form compared to publicly traded positions. Recognizing that the capital will be illiquid for the typically 10+ year fund life is key when considering the ultimate allocation percentage, especially in more growth-oriented strategies where regular income distributions are not likely. As the publicly traded investment universe continues to shrink, we believe Private Equity can be an important component when building a diversified portfolio.

For more information on how to access PPB’s platform, please contact Frank Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners, 484.278.4017 Ext. 108 or at [email protected].

PPB – April 2021 Market Update

Chart Source: Preqin