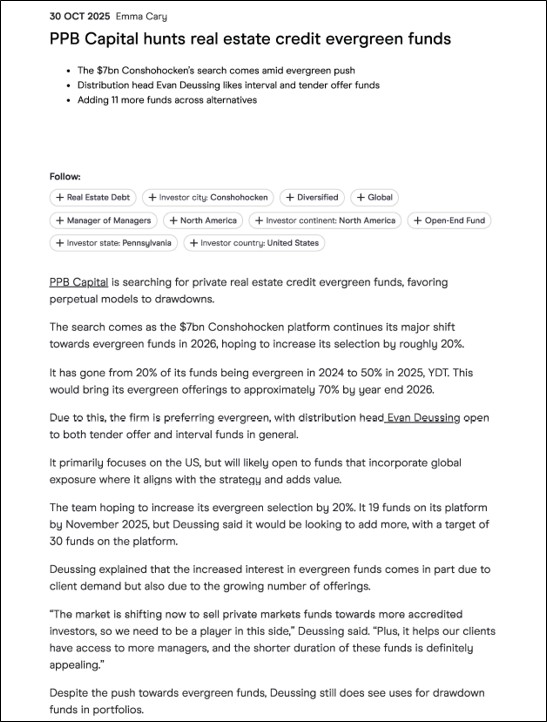

PPB in the News: PPB Capital Partners Hunts Real Estate Credit Evergreen Funds

November 25, 2025

Accelerating the Shift Toward Evergreen Private Markets Solutions

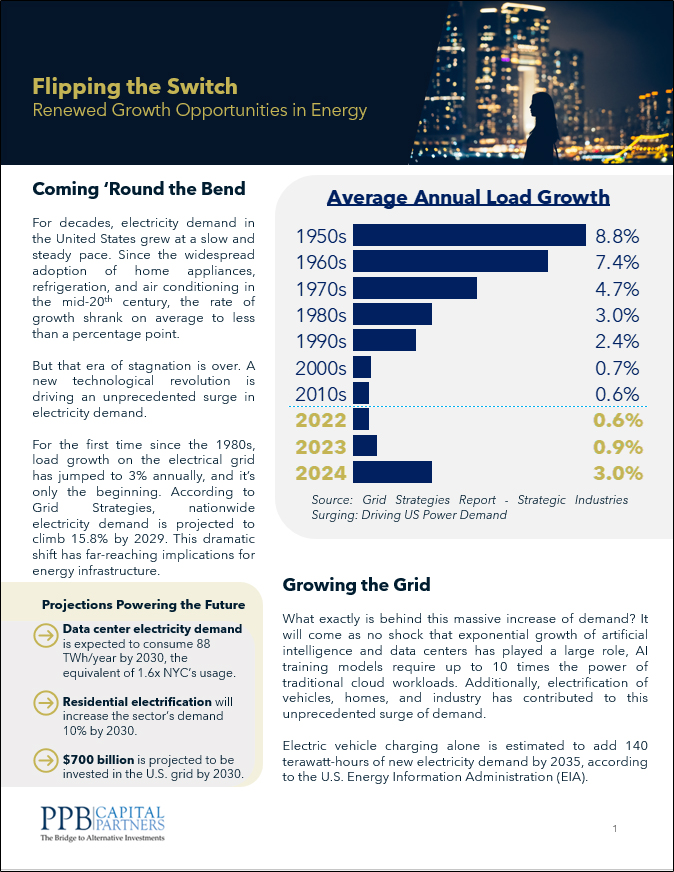

In an interview with With Intelligence, PPB Capital Partners describes how the firm is accelerating pivot toward evergreen private markets solutions, particularly in real estate credit. The $7bn Conshohocken-based platform has rapidly expanded its evergreen footprint—from 20% of its lineup in 2024 to 50% in 2025—and is targeting roughly 70% by the end of 2026. PPB noted that the shift is driven both by client demand and the expanding universe of perpetual-life strategies, with PPB favoring interval and tender-offer structures for their shorter duration and improved access for accredited investors. While U.S.-focused managers remain the priority, PPB is open to strategies with selective global exposure where it adds value.

PPB emphasized that evergreen funds will represent the core of PPB’s growth, as the firm plans to expand from 19 funds in late 2025 to a target of 30. Still, drawdown vehicles continue to play a role, particularly for core allocations and unique, less wrapper-friendly segments such as venture capital. PPB avoids overlapping strategies to prevent internal competition, maintaining a lineup that spans litigation finance, workforce housing, energy infrastructure, and digital assets, with new additions expected in areas such as distressed credit, entertainment royalties, direct secondaries, and option-exercise financing. The firm maintains a preference for managers with decade-plus track records, while selectively engaging emerging managers in evolving asset classes, supported by third-party diligence through Castle Hall.

Key Topics Covered:

- Scaling evergreen real estate credit offerings as client demand and market supply accelerate.

- Determining where evergreen vs. drawdown structures best fit across private markets strategies.

- Building a diversified, non-cannibalizing fund lineup while targeting meaningful platform growth.

*Login required