Unlocking Uncorrelated Returns: The Rising Role of Litigation Finance in Alternative Investments

March 3, 2025

By Frank A. Burke, CFA, CAIA, Chief Investment Officer, and Anton W. Golding, Director, Advisor Relations at PPB Capital Partners

A true alternative investment, litigation finance can aid legal proceedings that require significant capital and resources while offering investors high-yield income and uncorrelated returns. While sometimes an expensive form of financing, these private investments allow cases to proceed when they otherwise might run out of steam.

The Case for Litigation Finance

Opportunities in litigation finance (or “LitFin” for short) are typically categorized by the type of litigation (e.g., commercial, mass tort, international arbitration, etc.) and how the financing is structured, which typically is in the form of a loan directly to a law firm or by lending against a specific case or docket.

For many years, regulations have placed restrictions on the types of financing available to law firms. These were enacted to prevent what would become an abject perversion of the legal system, which lies at the core of a functioning liberal democracy.

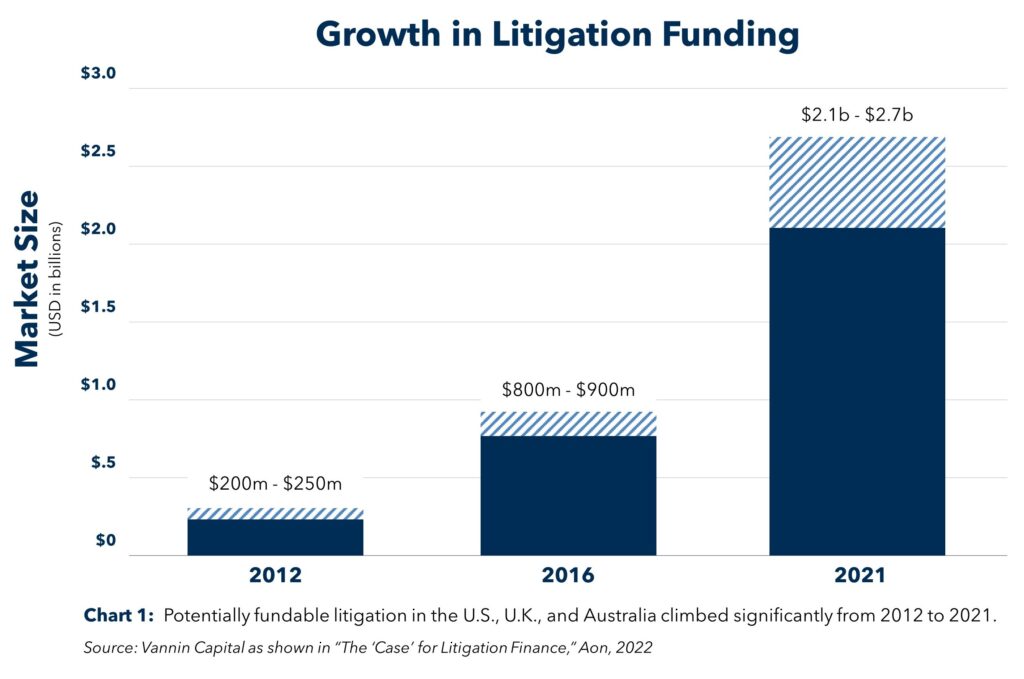

Throughout the life of a case, however, firms will incur considerable expenses that are expected to be fully recovered by the damages awarded through a favorable verdict. This is commonly known as “No Win No Fee.” Law firms do not have access to funding from traditional capital markets like many businesses. When combining that with the apprehension of banks to take on case/docket-backed loans, there is a dearth of capital-infusion opportunities in capital-intensive cases. While still a heavily regulated industry, restrictions on financing for law firms have loosened in recent years. Limited access to capital combined with this decreased regulation has led to an explosion of private market litigation financing, with a +10x expansion in the market from 2012 to 2021 (see Chart 1)1. Despite this growth, LitFin is still an incredibly small market—relative to other alternative strategies. Considering the nuances of this niche market, LitFin investments have a certain level of inherent risk that requires expert hands to navigate.

While some pundits may question whether it is a societal positive to further integrate private investing with our courts, many see this free flow of capital as having the same effect as efficient capital markets. Without funding, victims of wrongdoing may have difficulty seeking justice, or bad actors may not face the appropriate repercussions of their actions.

Supply, Demand, and Opportunity

Looking at LitFin in a vacuum, the number of law firms seeking financing (demand) is disproportionate to the number of institutions willing to underwrite loans (supply). As we learned in our university lecture halls, low supply and high demand result in higher prices for that service. Considering the current dynamics of this niche market, the cost of receiving litigation financing is typically much higher than in other industries. Such a dynamic will likely exist for years to come as regulations are still tight, potentially creating opportunities for investors.

The terms of litigation financing can depend on many factors, one of the most important of which is the stage of the case’s lifecycle. Much like traditional fixed-income offerings (in a healthy market), longer-dated loans typically have higher interest rates. Rates associated with LitFin, regardless of duration, are likely to be higher than traditional counterparts. Even as the Fed continues monetary tightening, making some alternative income sources less attractive, litigation financing terms have benefited with yields that maintain investor appeal.

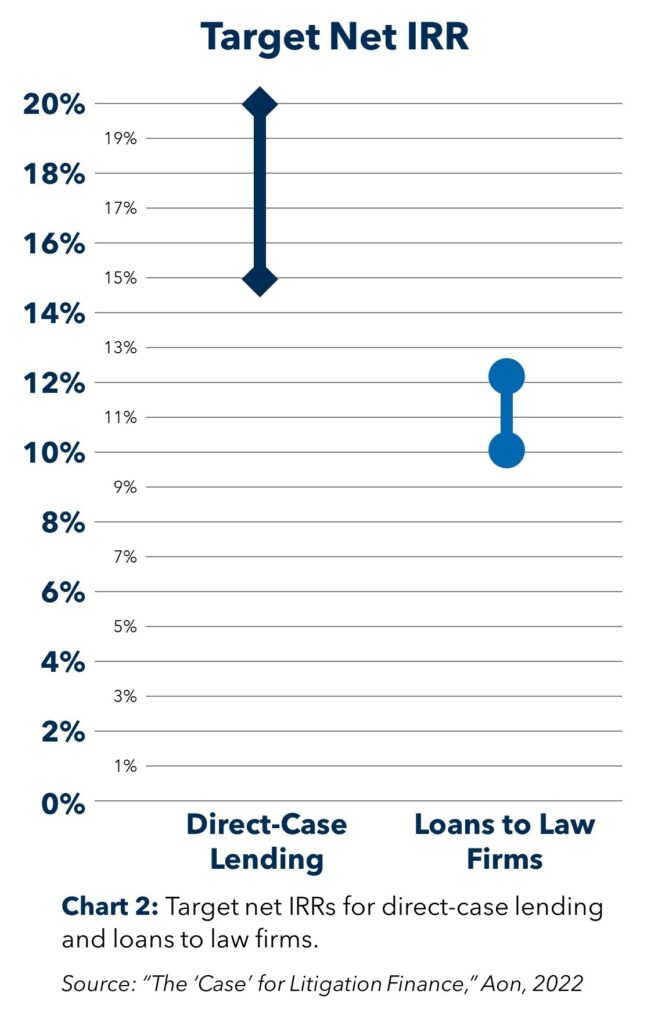

Apart from interest rates, investments in the LitFin space have little correlation to public markets and offer diversification in the truest sense. Bull market or bear, boom or bust, the courts will remain open, and firms will continue to require capital as they seek justice for their clients. Despite the relatively small market for litigation finance, there remains a wide variety of strategies that may complement either portfolio’s risk-on and growth investments or diversify an income-focused allocation. Funds focused on the early stages of cases—where the outcome is unknown—may have risk profiles similar to those often found in venture capital. Other strategies can take a more risk-adjusted approach by refinancing late-stafe lifecycle cases where outcomes are known or when settlements are in process. As with all investments, the tradeoff for lower-risk opportunities is the potential for lower returns. While performance data is relatively scarce, research from Aon indicates target net IRRs for direct case lending and loans to law firms range from 15-20% and 10-12%, respectively (Chart 2).

Despite all of this, no matter the stage of investment, litigation finance may be a valued component in an allocator’s private market sleeve. In the truest sense, litigation finance may provide investors with diversification and uncorrelated returns.

Footnotes and Important Disclosures

1 “The ‘Case’ for Litigation Finance,” Aon, 2022 (https://insights-north-america.aon.com/investment/aon-thecaseforlitigationfinance-whitepaper)

Additional sources:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3751369

This report is for informational purposes only, and does not constitute an offer to sell, or the solicitation of an offer to buy, any interest or investment in the Fund. Past performance is not a guarantee of future results.

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

Disclosure: Information presented is for educational purposes only, are subject to change from time to time and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.