Across the Pond

Real Estate Bust. Right time, wrong place.

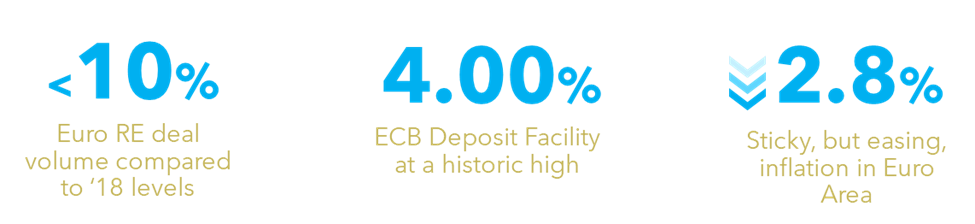

Analysts and journalists have long been discussing the impending commercial real estate collapse in the US. However, European deals have already fallen off a cliff in both value and volume. Significant and sticky inflation caused the implementation of aggressive monetary policy that has essentially brought the real estate market to a halt.

Opportunistic investors are left with a chance to capitalize on undervalued or untapped European assets. In this paper, we hone in on one area of interest, European hospitality assets. Here’s why:

- Hotel value and expansion. Tourism around the world is back. Reaching nearly 2019 highs, 2023 brought more than 700 million travelers to Europe.

- Undervalued residential real estate. The highly fragmented nature present in certain rental properties can be rip for opportunistic investors.

- Spectacular entertainment. Europe is set to host various events including the Olympics, UEFA Euro, Taylor Swift, Bruce Springsteen, and Metallica to name a few. Such spectacles will undoubtedly aid the tourism sector.

Evaluating real estate exposure at an opportune time

As you think about ways to bring diversification and income to your clients’ portfolios, often untapped and overlooked market sectors surface to add value. That’s why it’s critical to ensure your manager research process leaves no stone unturned and is highly in tune with policies that can bring benefits for opportunistic investors.

Incorporating boutique or niche managers allow for uncorrelated returns, and in turn, downside risk protection in ways you might not have considered. Simply buying a distressed property in Europe can limit full potential. Investors need to look for high-quality assets that have been squeezed, like hospitality.

“Opportunistic investors can take advantage of the current stressed market environment to buy quality assets from owners with bad balance sheets.” – Anton Golding, Director, Investment Strategist, PPB Capital Partners. Ask Anton a question.

Term definitions – ECB: European Central Bank, RevPAR: Revenue per available room