Commercial Real Estate: Vision Meets Expertise

July 21, 2025

Unlocking Value One Property at a Time

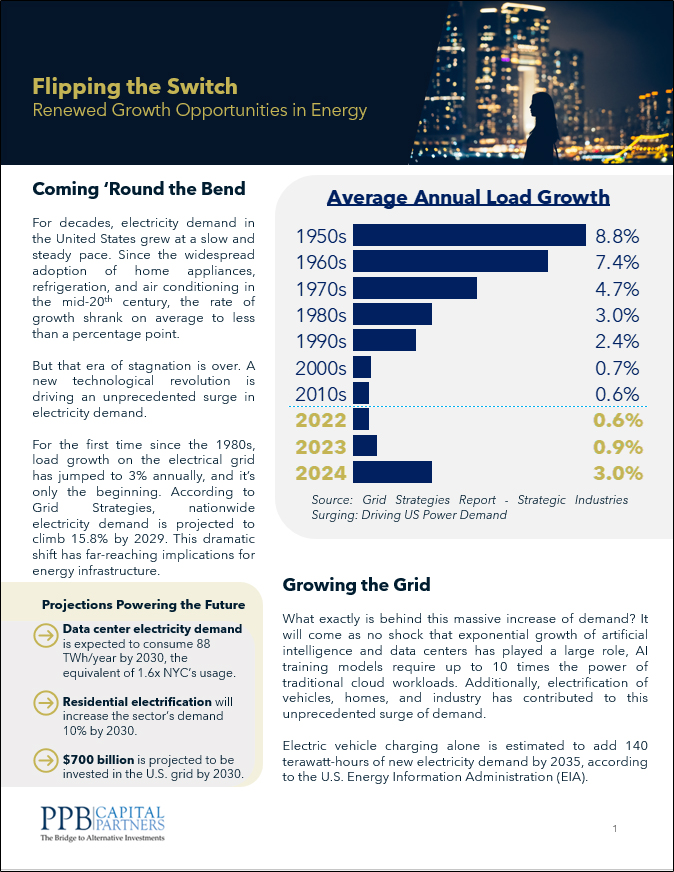

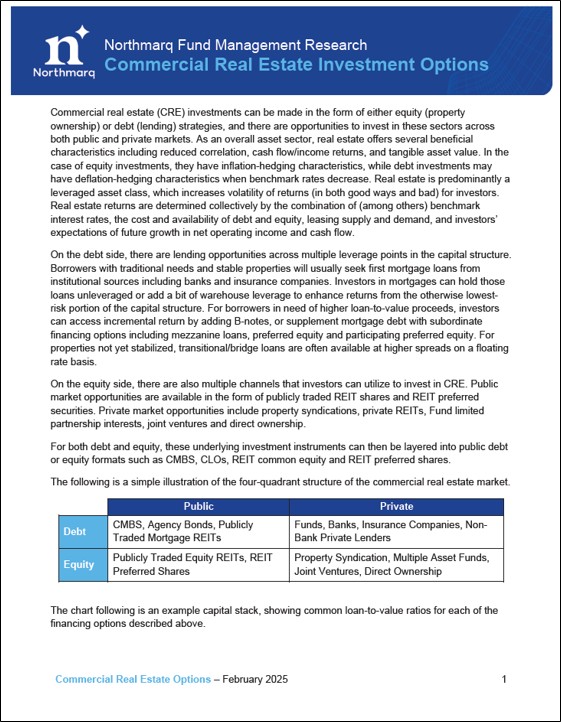

Commercial real estate (CRE) offers a compelling investment avenue with diverse opportunities across both equity (direct property ownership) and debt (lending secured by property) in public and private markets. This asset class generally provides diversification benefits due to its reduced correlation with other investments, and generates cash flow and appreciation potential backed by tangible assets.

Strong Returns with Diversification

Over extended periods, real estate investments can offer attractive returns and excellent diversification for portfolios. While stocks and Public REITs have periods of higher average returns, they may suffer from greater correlation and volatility. The attached report from Northmarq Fund Management highlights one of these periods, from 2010 to 2023 during which private real estate equity (8.5% average return) and high-yield private real estate debt (8.4% average return) delivered strong returns with less volatility than stocks or Public REITs.1 High-yield real estate debt, in particular, showed favorable risk-adjusted returns, outperforming its own volatility. In contrast, bonds struggled during this period.

Real estate investments also provide significant diversification benefits. Different types of real estate generally have low (or even negative) correlations with other major assets, and even among themselves. This means adding various real estate investments to your portfolio can significantly enhance diversification and potentially offer new sources of yield.

- This timeframe was chosen to make accurate comparisons; some post-2023 data was unavailable at the time of publication. ↩︎

Here are a few questions to consider as you explore commercial real estate investment opportunities:

- What CRE alternatives are you exploring for steady returns?

- Are you leveraging value-add and opportunistic strategies?

- How are you accessing public vs. private real estate markets to meet your investment goals?

*Northmarq Fund Management is the author and sole source of the commentary above

About Northmarq Fund Management

Northmarq Fund Management invests in mortgages, mezzanine loans, preferred equity, and equity across all product categories. Specializing in small balance, mid-market commercial real estate investments, Northmarq Fund Management can tailor capital structures specific to each potential transaction. Northmarq is one of the largest privately held commercial real estate firms in the nation. Northmarq provides debt origination, loan servicing, investment sales, and investment management services nationwide.

Learn more about our managers and what we offer to scale your business.