Growing Opportunities in Critical Technology

November 30, 2022

By Frank A. Burke, CFA, CAIA, Chief Investment Officer, PPB Capital Partners

and Anton W. Golding, Associate, Fund Manager Analyst

Speak to anyone who currently has teen or preteen children, and many of them will tell you that their kids spend an inordinate amount of time staring at the screen of their smartphone or tablet. In many ways, that 2-D world has overtaken their personal interactions with 3-D people.

While kids being spellbound by the blue glow of smartphones and tablets is merely an example of how our reliance on technology has evolved, the degree to which we have become dependent on technology goes much deeper. The perceived “zombification” of our youth can be another discussion for another time—in likely another forum. But this discussion will key in on how the ripple effect of our infatuation with technology influences the microscopic innards that make devices like those smartphones and tablets tick, with a slight detour to consider protecting against the potential perils of using them.

By taking a closer look at information technology and other innovative industries, we saw dramatic multiple compressions throughout 2022. This has potentially created buying opportunities for long-term capital allocators in both public and private markets.

As 2022 draws to a close, the roar of the bear market continues to echo through the information technology sector and other innovative industries. The tech-heavy NASDAQ Composite remains down approximately 30% year-to-date. It is trading at a 24x price/earnings multiple compared to 36x at this time last year.1 Rising interest rates and fears of a potential global recession have led analysts to revise earnings and revenue estimates downwards, which has resulted in market capitulation and collapsing multiples.

However, this sell-off has produced attractive valuations and opportunities in industries which can be classified as “modern critical infrastructure.” These circumstances have created a swell of capital raises in technology—and innovation—focused private equity and credit funds throughout 2022 at rates on pace with recent historical trends.

Recent challenges to the existing international order, including the Russian invasion of Ukraine, Chinese military activity near Taiwan and countless cyber-attacks, have underscored the necessity for American industry and government to secure and strengthen its modern critical infrastructure. There are few industries more vital to the modern economy than semiconductors.

Earlier this summer, the US government enacted the $280 billion CHIPS & Science Act, which includes $52 billion for domestic semiconductor research and production. The Act is a step towards reducing our reliance on global supply chains that have proven to be suspect and provides the resources for the private sector to continue innovating at remarkable speeds.

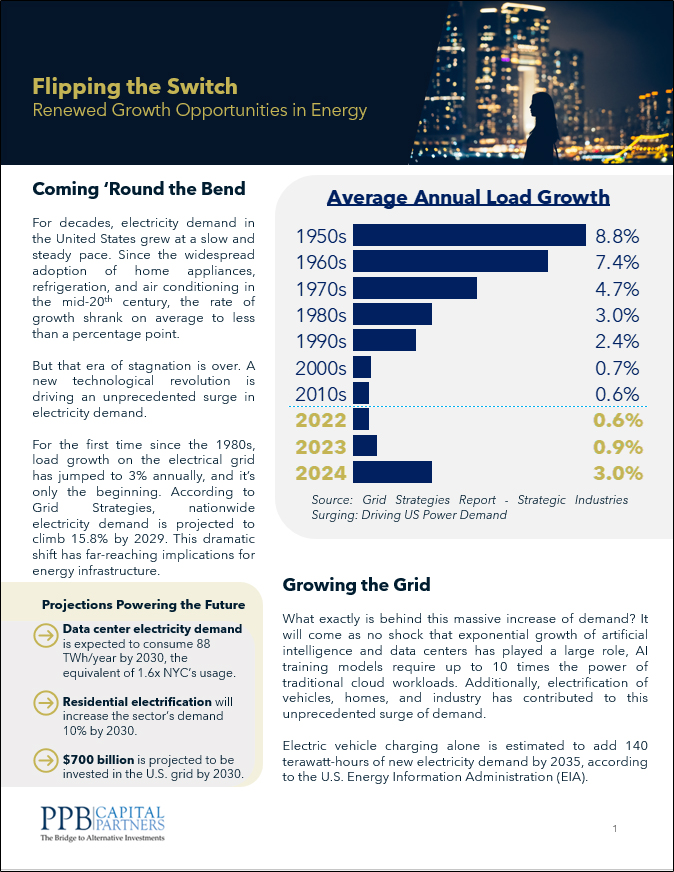

Shipments of silicon materials and wafers, which are crucial to chip production, have more than doubled since 2005, as illustrated in Chart 1. Many aspects of modern life rely on semiconductors—from electric cars and 5G phones, to home appliances and electronic retail payment terminals, and guidance and operating systems for myriad military defense equipment. Should the worst fears of global recession come to light, semiconductor research, development and manufacturing will remain essential to the American economy.

In the last year, expectations of decreased corporate expenditures have resulted in poor market returns for the software industry, inclusive of cybersecurity firms. However, universal spending cuts are historically lower than what might be expected. Chart 2 illustrates the resilience of IT spending through difficult economic times. Furthermore, cybersecurity software has proven to be a component too vital to cut.

This was apparent in the 2020 ransomware attack on the Colonial Pipeline. The subsequent (albeit short) energy crisis in the eastern United States validated the need for quality cyber defense. As has been the case throughout 2022 for the overall technology sector, cybersecurity indices are similarly down by approximately 30%. As this important industry continues to evolve, opportunities for market consolidation, buyouts and growth-stage investments may be realized.

Lower market valuations in some aspects of modern critical infrastructure provide long-term investors the opportunity to participate in positive secular trends at attractive prices—especially given the current state of public markets. Year to date in 2022, more than 560 tech/innovation-focused private equity and credit funds have closed capital raises, which is on par with most of the last decade.2 This comes after an historic 1,005 closes in 2021, as low rates, high growth, and increased market participation led to high valuations.2 With more reasonable prices today and lagging private market valuations, private funds deploying capital throughout the next 18 months can potentially see an abundance of opportunities for long term returns.

PPB – November 2022 Market Blog

Footnotes and Important Disclosures

1. FactSet, Dow Jones

2. Preqin

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto.

The underlying Fund information discussed or included in the segments of private equity discussed, represents that of Private entities which are not required to file with Preqin. The data given in this document is composed of all data that has been filed with Preqin but is not comprised of the information from every Private Equity Fund. .

Certain securities offered through Registered Representative with Vigilant Distributors LLC (Member FINRA/SIPC), which is not affiliated with PPB Capital Partners or its affiliates.