We are Hiring! Click here to see our open positions.

Demystify Non-Traded Investments While Underscoring Control

calendar_today December 13, 2022

By Frank A. Burke, CFA, CAIA

Chief Investment Officer

with

Anton W. Golding

Associate, Fund Manager Analyst

In recent days, investors have been inundated with headlines about unlisted funds hitting redemption limits and gates closing on client outflows. While this has made front page news at all major financial journals recently, these structural issues and limitations are anything but new.

Often pitched as semi-liquid solutions for wealthy individuals to invest in private markets, the true liquidity and transparency of such funds have long been oversold. This may leave investors and their wealth advisors in compromising positions, while also creating opportunities for allocators well-versed in the secondary market to pick up shares at a discount.

With that in mind, it’s important to know how an investment like this will fit in the client’s current portfolio makeup and how it lines up with their ultimate goals, preferences and needs. History has told us that the best—and possibly first—question a wealth advisor can ask is: “Is this the best structure for my client?”

But before we examine other avenues, let’s first look at why we are here…

Closed-end funds have pre-set withdrawal redemption limits. Investors may request a withdrawal for any reason—be it a sudden need for liquidity or a downturn in the fund’s performance. When there is a surge on withdrawal requests exceeding that threshold, limits must be enforced.

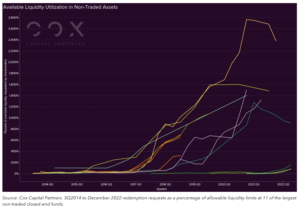

This chart illustrates this concept as it relates to historic redemption requests as a percentage of allowable liquidity limits. As fund sponsors close the gates, a common emotional reaction from investors is a panic-driven “run on the bank.” When this happens, the fund receives an exponential rise of redemption requests, which may cause an abrupt sale of holdings, followed closely by a cycle of pressured returns and further increasing redemptions.

The key is fund managers have the ultimate control of liquidity. And in a declining market, the valuation of the fund decreases along with flows into it. In situations when a fund that previously provided liquidity in any given quarter is suddenly cutting back the requested redemption amount to investors, wealth advisors can feel rightfully burned.

The best possible client experience must remain one of the foremost goals of any wealth advisor’s strategy. To create that, it is necessary to have an auxiliary path to alternative investing where the advisor has additional control of liquidity.

As a former member of the portfolio management team at a registered fund-of-funds, I have first-hand experience with this. There are logistical challenges that come with managing liquidity in a structure offering quarterly redemptions while having a significant allocation to private investments.

These structures work well when times are good and new assets are coming in. But when the flows stop, redemption pressures can exacerbate, and managers are often forced to restrict liquidity. However, once a fund manager goes down that path, investors often begin to panic and rush into the queue for redemptions, only adding more pressure to the fund.

The ensuing tight rope walk by the fund manager can be harrowing. The manager must balance how to keep the portfolio in a strong position for ongoing investors, versus selling off portfolio positions to accommodate the redemption requests. In essence, avoiding a fire sale while still providing liquidity. From those perspectives, the decision to limit withdrawals can be justified. From a public relations and business development perspective, there is the potential for harm.

So yes, the struggle is real. What is the best way to harvest alternative asset exposure for clients without the negative headlines that may potentially harm the wealth advisor’s relationships?

For many wealth advisors, a customized fund-of-fund model is a more controllable alternative, especially to the closed-end funds that have been in the news recently. When creating a custom fund structure such as this, the wealth advisors have the final say as to which investments are included and how it is constructed. If a client will be requesting liquidity, the wealth advisor has the latitude to make sure the investments meet those requests.

In such a structure, wealth advisors have control of the process from beginning to end, and without the necessity of dealing with commission-focused broker-dealers. Customized fund-of-funds allow wealth advisors to focus solely on what is best for their clients. From choosing the right mangers and deals, to legal design and structure, customized fund-of-funds put power back in the hands of wealth advisors and their clients.

Regular communication with the client, however, is the most important step to the best experience. As a fiduciary, the ultimate questions you must answer are:

“Will this help my client reach their goals?”

“Will there be enough liquidity for any forthcoming redemption requests?”

“Given their current portfolio, is this a suitable investment for my client?”

Without the answers to these questions, many wealth advisors would likely be allocating to their clients’ portfolios blindly.

For more information on custom fund-of-fund structures, contact us to set up a meeting.

PPB – December 2022 Market Blog

Important Disclosures

This document or any part thereof may not be reproduced, distributed or in any way represented without the express written consent of PPB Capital Partners, LLC. A copy of PPB Capital Partners, LLC’s written disclosure statement as set forth on Form ADV is available upon request. Although the information provided has been obtained from sources which PPB Capital Partners, LLC believes to be reliable, it does not guarantee the accuracy of such information and such information may be incomplete or condensed. PPB Advisors, LLC is an affiliate of PPB Capital Partners, LLC by virtue of common control or ownership.

The statements included in this material may constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Some of these forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, or “anticipates”, or the negative thereof or other variations thereof or other variations thereon or comparable terminology. Due to these various risks and uncertainties, actual events or results of the actual performance of an investment may differ materially from those reflected or contemplated in such forward-looking statements and no assurances can be given with respect thereto.

The underlying Fund information discussed or included in the segments of private equity discussed, represents that of Private entities which are not required to file with Preqin. The data given in this document is composed of all data that has been filed with Preqin but is not comprised of the information from every Private Equity Fund. .

Certain securities offered through Registered Representative with Vigilant Distributors LLC (Member FINRA/SIPC), which is not affiliated with PPB Capital Partners or its affiliates.

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- September 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- June 2018

- December 2017

- June 2017

- March 2017

Recent Posts

- Investment check-in: why now may be an opportune time to diversify with alternatives

- Is now the right time to outsource the operations of your in-house alternative investment funds?

- Financial Advisor Magazine: The Hunt for Alpha

- Across the Pond

- 2024 Global Outlook

- With Intelligence: PPB Capital Partners seeking specialty finance strats

- With Intelligence: PPB Capital Mulls Sports Financing Opportunities

- PPB Capital Partners Promotes Amanda Bannon to Chief Operating Officer

- Time to Buyout?

- PPB Capital Partners Named One of Philadelphia’s Fastest Growing Businesses

- Financing the Future

- Getting to know Carly Kramer of PPB Capital Partners

- Getting to Know Matt Williams of PPB Capital Partners

- Judge for Yourself

- Getting to Know Anton Golding of PPB Capital Partners

- PPB Capital Partners Expands Distribution, Operations Teams To Serve Wealth Advisor Partners, Meet Growing Demand

- Office Space Oddity

- Maintaining Face Time in a Remote World

- Getting to Know Andrew Sussingham of PPB Capital Partners

- Creating Custom Solutions

- Break on Through (to the Other Side): Post-Pandemic Trends and Opportunities in the Hospitality Industry

- Getting to Know Ed Chandler of PPB Capital Partners

- Learning From an Old Fashioned “Run on the Bank”

- Connecting a Remote Staff Through Culture

- Aligned with Wealth Advisors

- “There’s No Place Like Home…”

- Get to Know Vikki McLaughlin of PPB Capital Partners

- Loyalty

- “It was the Best of Markets . . .”